Digital & Robo Advisor: A Big Opportunity for the Australian Wealth Industry

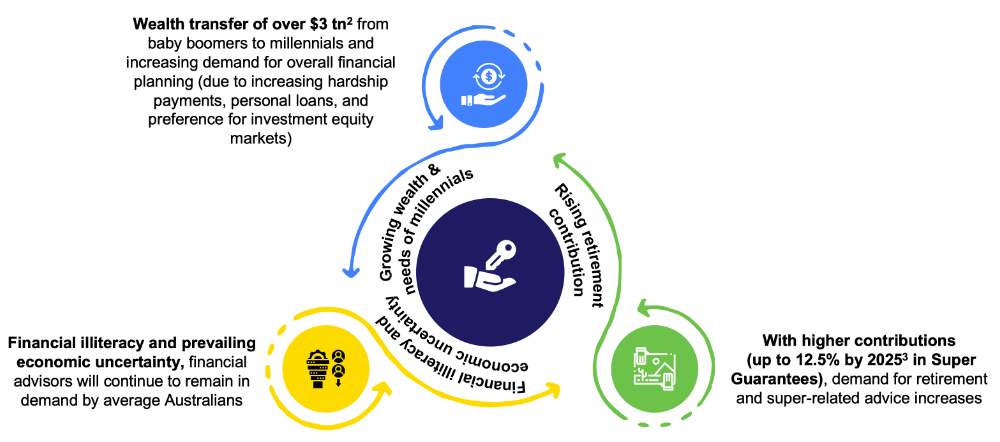

Figure 1: Factors influencing growth in financial advice.

This is a unique opportunity for financial institutions like banking, super annuation and wealth management firms, as most of these entities offer advisory services through licensee organizations or independent financial advisors. However, with post-Royal commission interventions and amidst consolidation within the Australian wealth and super industry, over 9,000 financial advisors have exited the markets. By 2023, these numbers are expected to drop further, from 19,000 currently to 13,000, representing more than a 50% decline from 2018. This abrupt exit has created a significant supply-demand gap for existing customers, licensees, and associated institutions. That gap is likely to increase further by 2030, with Australia’s population expected to reach thirty million, and only seven million people expected to have access to a financial advisor

In addition to the supply-demand gap, the cost of financial advice offered by human advisors has also grown by almost 30% in the last two years, to the present median fee of over $3,000 a year4.This high costs is unviable, as it limits the scaling of financial advice in human-advisor centric models. The scarcity of advisors and high cost of advice present a unique opportunity for financial service providers to pull ahead by providing universal access through a technology-enabled digital financial advisor.

The necessity of an affordable financial advisor

Affordable financial advice is an integral part of providing personal financial planning services to customers. Hence, it is a good time for financial institutions like bankers, insurers, wealth services providers, and super funds to develop affordable and scalable financial advice as a strategic area and focus on developing capabilities for robo- advisory.

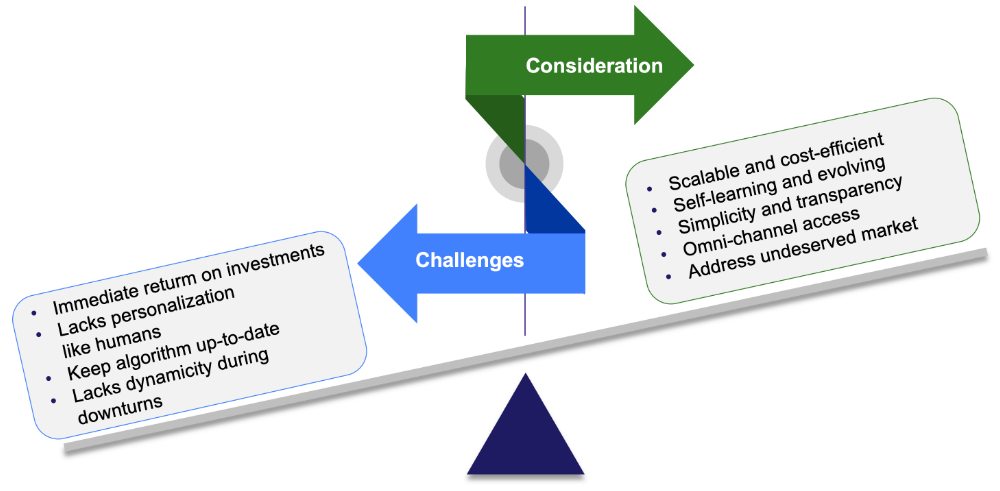

While automation and robo advisory services are the two major trends governing the strategic orientation of financial institution, several market leaders have adopted robotic process automation (RPA) to automate statements and routine transactions, which helps optimize cost and establish automated processes. However, in contrast to implementing automation initiatives, digital robo advisor require a more strategic approach as it offers both opportunities and challenges, which demands due considerations (Figure 2 below).

At one end, robo advisors can significantly cut costs and increase scalability. On the other hand, the cost and effort required to develop a digital robo advisor capable of providing personalized “human-like” financial advice is significant.

The short-term business case for robo advisors may not be immediately justifiable and is a likely limitation. Firms should therefore adopt a more holistic approach that focuses on developing robo advisor services strategically and gradually.

Figure 2: Challenges and considerations of digital robo advisor.

A holistic approach to develop comprehensive robo advisor

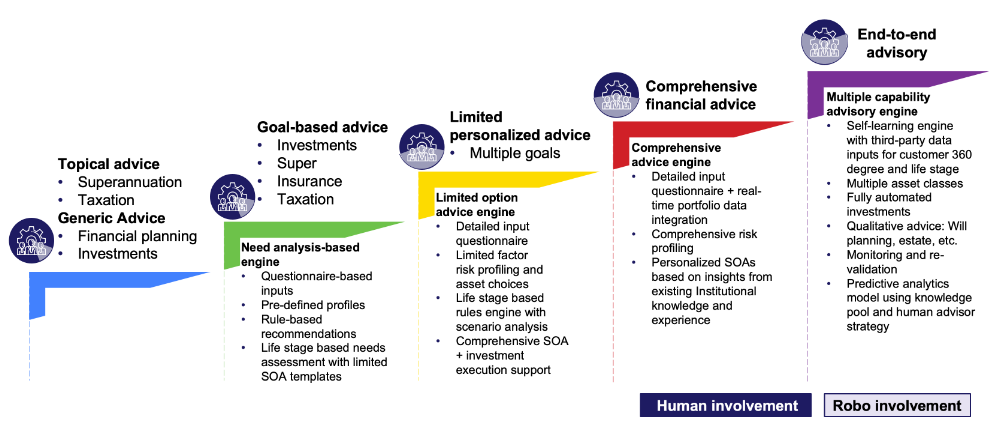

The capabilities and scope of a robo advisor depend on the organization’s business plans and investments in new initiatives. Financial institutions should develop a roadmap to align the development of their robo advisor services with their business models, strategies, and shifting customer needs. The framework below provides an agile approach for a typical financial institution with an established advice channel. For more detail on scope, challenges, and future opportunities, read our report “Future of Robo-Advisors in Investment and Wealth Management.”

This agile framework in Figure 3 outlines a systematic approach to digital enablement, which can help in achieving a comprehensive digital robo engine. This approach also encourages firms to gather insights on customer experiences and human advisors, then use these insights to train their advisor engines, helping them develop into more competent, end-to-end robo advisors.

Figure 3: Roadmap for digital & robo advisor enablement.

The roadmap in Figure 3 can help financial institutions by encouraging a steady transformation from generic to specialized financial advisory engine. Its stepwise approach also guides firms through incremental investments that have the flexibility to accommodate dynamic customer needs, and the progressive development of robo advisor capacity to gradually reduce dependency on human teams.

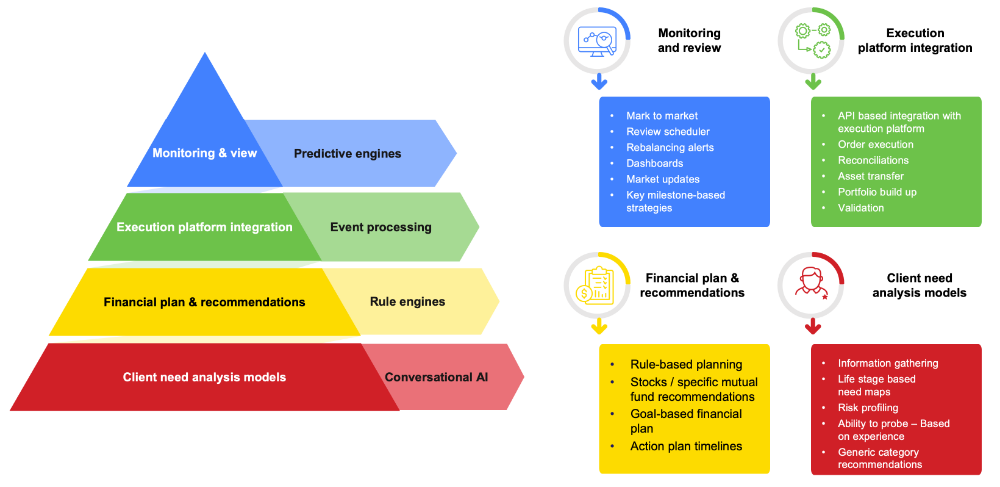

To see this roadmap through, financial institutions need to develop the capability blocks described in Figure 4.

Figure 4: Capabilities map for digital & robo advisors.

Firms can get closer to achieving the capabilities in Figure 4, in sync with the roadmap in Figure 3, by employing a highly collaborative approach that combines people, technology, and digital to deliver the following:

The way forward

By embracing technological advancements, financial institutions can reduce their dependency on human-centric models to a more scalable digital model. However, to customers seeking both human and digital financial advice, firms need to adopt a hybrid approach that keeps human advisors relevant while developing robo advisors.

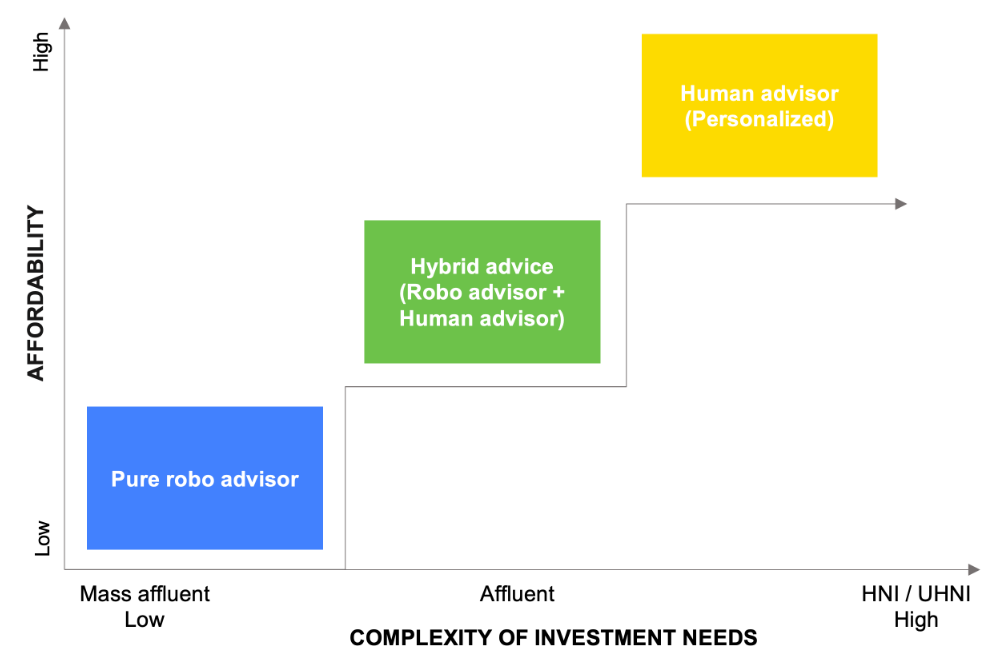

Despite the growing demand for financial advice, there are challenges like low availability of financial advisors and the growing cost of delivering financial advice. Robo advisors can help financial institutions serve the mass-affluent segment with low affordability while extending their reach to underserved customers. With limited human advisors, firms can focus more on serving the HNI/UHNI segment. The robo advisor would also enable them to offer hybrid services, which would suit the investment needs of the affluent class seeking both humans and robo advice. Hence, transitioning from a human-only model to a hybrid-digital model would enable financial institutions to leverage their investments in people and technology, and offer superior customer experience to Australian investors.

Figure 5: Affordability vs. complexity of Investment needs by investor class.

Transitioning from a human-centric model to a hybrid-advisory model with digital robo advisors can help Australian financial institutions increase efficiencies in the following ways:

Conclusion

Australia’s robo advice market has the potential of $60 billion in funds under advice5. The digital and robo advisor offers a unique opportunity for financial institutions to bridge the supply-demand gap. Financial institutions can adopt robo-advisory-driven financial advice models and launch their offerings to increase their scale and volumes. Digital and robo advisory capabilities seek strategic investment and offer significant growth opportunities for Australian financial institutions. Therefore, considerable efforts with a focused approach are required to secure long-term sustainability and potential value creation for Australian investors in their financial planning decisions.

References

Industry :