Petroleum retail companies are fundamentally in the consumer mobility business.

As such, they are focusing more closely on consumer needs across all touchpoints of the customer experience. Companies are quickly transforming as they strive to improve all facets of customer experience and engagement. Digital technologies like cloud, data analytics and artificial intelligence are enhancing these customer journeys.

Retailers across the board are now focusing on much more than in-store engagement. They are building integrated engagement strategies comprised of both physical and digital channels, including in-store, web, mobile and social media. In keeping with these trends, petroleum retailers (consumer mobility providers) are building new customer-centric engagement strategies for the multiple streams of business driven from forecourts. These new strategies, in turn, will potentially redefine all their operational channels.

While a customer-centric strategy can deliver an elevated brand experience, a complete offering has to deliver higher value at each stage of brand engagement and at every transaction. Rewarding customers with superior value propositions and quality service delivery across channels is a difficult ask given volatile fuel prices, stagnating demand and shrinking fuel margins. For the customer to enjoy higher service levels and better value for the money spent, consumer mobility providers must look to increase the customer basket size, and cross-sell and upsell more profitable product categories across both fuel and non-fuel retail. The objective should be to create a highly engaging, long-lasting personalized relationship with each customer, from which both parties benefit.

As early as April 2021, a McKinsey survey showed that pandemic-driven digital adoption by consumers had largely plateaued but would remain well ahead of pre-pandemic levels. In this context, energy and mobility companies are seeking to retain new-age digital consumers by improving digital experiences, investing in phygital, and putting consumer trust at the heart of all they do. They plan to move from traditional forecourts to big box formats like site super-hubs and truck stops to meet diverse consumer requirements in fuel and non-fuel categories. With site super-hubs, they intend to focus on fulfilling diverse consumer requirements with loyalty systems, personalized offers, discounts, and mobile and web-based services that customers perceive as higher-value offerings.

Consumer mobility businesses already hold a significant amount of customer data. Why should they not unlock the value of this data by building an omni-channel marketing strategy? Given their wide variety of service offerings (groceries, beverages, vehicle service, hotel, hospitality, etc.), a comprehensive marketing strategy driven by data and personalization can be a powerful differentiator. Insights and data-driven targeted offerings, personalized promotions, one-on-one communications and digital payment solutions are the core capabilities that businesses will need to leverage to deliver customer-centric propositions. Developing these core capabilities and then developing technology solutions are very specialized tasks that require an all-encompassing, clearly defined digital strategy accounting for all aspects of operations. The lack of a digital strategy, including channel strategy, can lead to ad-hoc decision-making, incoherence from both a business and operations perspective, and a significant load of technical debt.

A comprehensive omni-channel strategy, captured as an element of digital strategy, will bring channels such as physical, social, mobile and web together and enhance them with the two other key elements of digital strategy: cloud and data.

Some factors that can hinder the formation and execution of an effective omni-channel strategy are:

A harmonized omni-channel strategy that embodies customer-centricity will seek to resolve all of the aforementioned roadblocks.

A complete 360-degree view of the customer is the backbone of a data-driven enterprise. It will capture both the historical and current context of the customer, and can include elements such as:

The customer 360-degree view enables personalized communications and leads directly to offer uptakes, revenue increases and improved customer satisfaction, resulting in sustainable and extended brand-customer relationships.

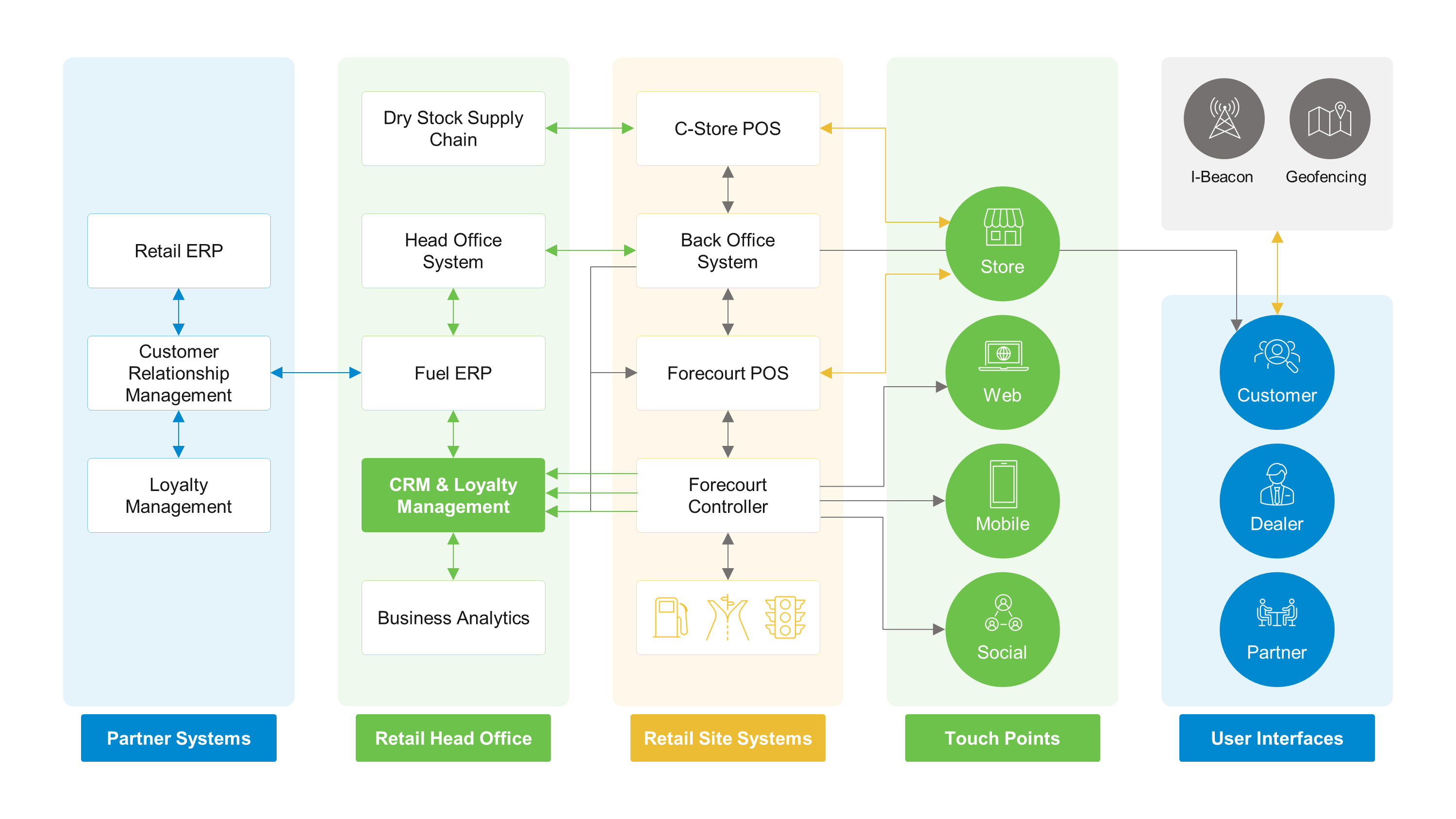

Data management becomes key to any intelligent insights-driven operations. A comprehensive data strategy is required, which identifies data ownership, data lifecycle management and use of data for driving processes — both back-end and customer-facing — resulting in more contextual and personalized engagement with customers. A connected business architecture that brings together back-end and front-end capability areas (see figure below) creates the right platform for developing a data-driven, customer-centric, omni-channel strategy.

From a data governance perspective, the core challenge for businesses is to manage both structured and unstructured data from an ever-increasing number of touchpoints and anticipate the implications of this data on the database infrastructure. The next challenge is to standardize point-of-sale (forecourt, C-Store, etc.) and order management processes across touchpoints, and to harmonize them with the core fuel retail system used by the enterprise and its retail promotion partners. Simultaneously, this process requires integrating the CRM and loyalty management systems of the enterprise and those of partners.

Fortunately, the groundwork for this transformation has already been put in place by retailers in other sectors. Petroleum retailers must adopt the technologies that work best for their needs (e.g., location-sensing technologies, augmented reality, real-time enterprise visibility of retail inventory) to give customers an engaging experience combined with endless retail aisle capabilities. Using a combination of these technologies, petroleum retailers and their franchisees can overcome the limitations of retail space and inventory that impact their non-fuel retail C-Store products and sales. In the future, for example, a customer might pre-order non-fuel products offered by fuel retailers over a mobile app and schedule a pickup that coincides with their morning commute.

Traditional business wisdom in retail has always dictated that increasing the number of outlets will increase reach and profitability. An omni-channel strategy is a digital extension of this traditional retail maxim. Moreover, an omni-channel approach is becoming an unavoidable imperative for petroleum retailers seeking to enhance the flexibility and scalability of their operations, provide a superior value proposition with respect to competitors, and discover new avenues for growth.

Sudhansu Choudhury

Consulting Partner, Wipro Energy Downstream Domain

Sudhansu is a chemical engineer with more than 20 years of experience in energy industry and IT domain consulting. His areas of focus have included B2B customer, mobility and fleet, LNG, refining and low-carbon energy. He has helped enterprises advance competency development, solution development and transformation initiatives for downstream product, as well as customer and low-carbon business in energy downstream.

Manu Sharma

Consulting Partner, Wipro Energy Downstream Domain

Manu is an instrumentation and control systems engineer with more than 25 years of experience spanning multiple industries including energy and utilities. He is focused on customer-centric transformation in the energy industry, along with diversification and development of new business models. He leads capability development and client consulting engagements related to business and digital transformation for global energy clients.