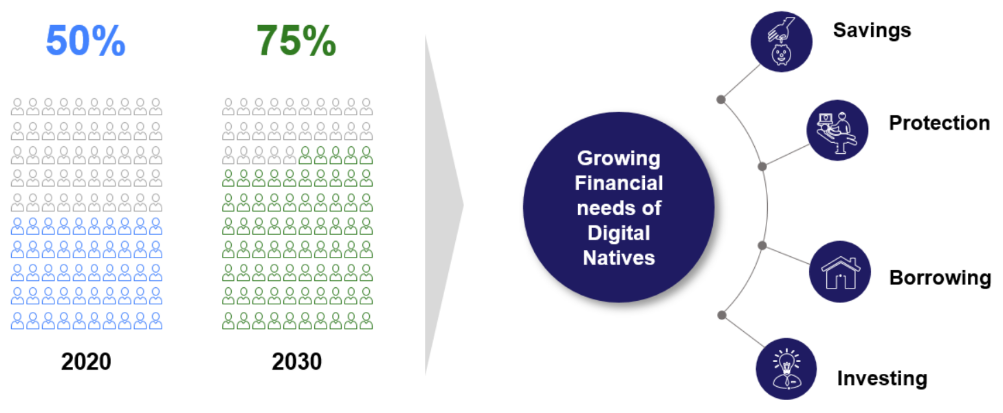

By 2030, millennial’s aggregate annual income is expected to surpass $4 trillion. They are also expected to hold five times as much wealth as they did in 2019, and to inherit more than $68 trillion from previous generations.

Millennials and Gen Z are making significant financial decisions. They are investing, setting long-term financial goals and buying insurance. Consumer preferences of these generations are influenced by their digital-first attitudes. They expect, for example, personalized services tailored to their demographics, interests, location, personality, across all interactions. To meet this demand for personalization, and keep pace with changing consumer preferences, insurers need to focus more on their data strategy.

Figure 1: Millennials and Gen Z will represent two-third of global labor force by 2030, and will have growing financial needs.

Harnessing the full power of big data

Our increasingly digitalized world produces huge amounts of data. IDC estimates that the amount of data generated over the next three years will surpass that generated over the past 30. Access to large volumes of third-party data is already helping insurers better understand their customers and develop new approaches to meet their needs. Based on elaborate data around clients’ lifestyles and behavior, insurers can offer customized products. Individual data from wearables, telematics, and IoT sensors, for example, help insurers personalize offerings while making prudent risk-specific underwriting decisions. Guided by customer data and insights, companies are now in a better position to upgrade and create agile risk models based on the fast-changing customer needs and behaviors.

Wipro worked with a large Australian Insurer to create an algorithm that allocates risk scores to individual vehicle drivers based on their driving behavior, enabling the insurer to identify potential red zones — high risks for exposure and loss probability. Our client was able to incentivize drivers to adopt safer driving behaviors by simultaneously offering discounts to drivers with superior risk scores and charging higher premiums to drivers with inferior risk scores. This hyper-personalized insurance product is a win-win for both customers and the insurer because the price is based on the individuals’ driving behavior, not simply on vehicles’ models and makes.

Hyper-personalization increases likelihood of favorable outcomes

Insurers are investing in building complex algorithms and data analytics platforms to track user behavior, buying patterns, and potential lifestyle needs. These investments aim to identify the ideal moment to pitch prospects to increase the probability of a sale. Examples include showing customers life insurance ads when their shopping online for wedding-related goods and services or purchasing baby diapers, or showing them a motor insurance ad after they’ve booked a test drive online. This hyper-personalized content can be created exclusively for an individual based on linked profiles, social media pages, and online shopping behavior.

An insurance platform from a leading Chinese technology conglomerate, in collaboration with well-known insurance companies, leveraged the conglomerate’s deep data analytics capabilities around online behavior and social insights to sell over 25 million policies in a year. This volume of sales constituted an exponential rise compared to previous years, and was largely attributed to the company’s ability to hyper-personalize insurance products based on customers’ needs.

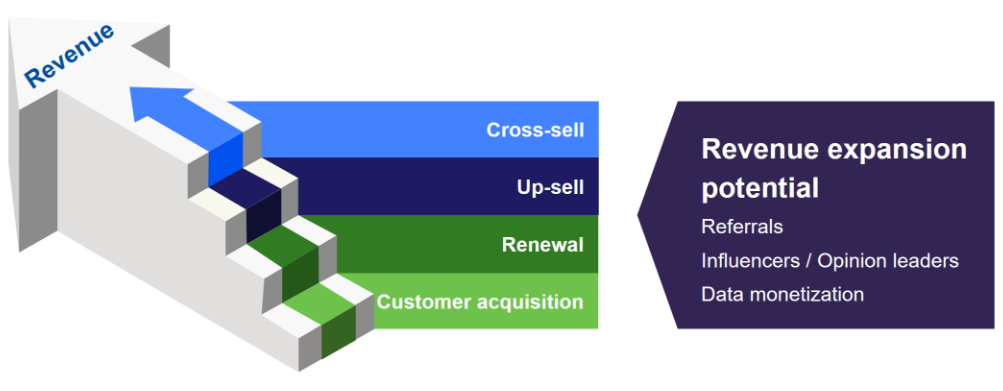

Hyper-personalization also addresses customer churn by enabling insurers to better engage customers and increase retention. The model not only facilitates the creation of suitable up-sell and cross-sell opportunities, but also enables optimization of the customer acquisition costs which can otherwise be significantly high.

Figure 2: Deep customer engagement drives customer lifetime value.

Auxiliary ecosystem data enables hyper-personalization

Insurers are also creating networks of connected products over and above their traditional insurance product offerings to support customer journeys across different life-stages. For instance, auto Insurers now offer support ecosystems for everything from accident assistance and repairs to temporary replacement vehicles. In these ecosystems, customer behavior is tracked to provide customers with the most relevant products and services to supplement their insurance coverage. By offering more comprehensive support for drivers, these data-driven ecosystems also promote policy renewals and successful cross-selling. Similarly, global life insurance groups are investing in wellness ecosystems aimed at improving customers’ health outcomes. These networks enable life insurance companies to gather data and feedback on the customer experience, then use those insights to create hyper-personalized products, communications, and services that benefit both the customers and the business.

New-age digital insurers or sub-brands have the advantage of speed and agility

Unlike new-age digital insurers, traditional insurers with legacy systems typically find it difficult to embark on hyper-personalization journeys. Upgrading legacy systems can help established insurers increase agility and personalize services. As-a-service models, including software as a service (SaaS) and platform as a service (PaaS), can also help large insurers achieve hyper-personalization. SaaS and PaaS are cost-efficient alternatives that enable speed and flexibility.

Some insurers are even creating new sub-brands to carve out hyper-personalized policies for millennials and Gen Z customers. A large Australian financial services provider created a separate cool sub-brand to offer hyper-personalized products to younger customers. This provider also adopted a PaaS model to power this journey, moving away from legacy systems.

Hyper-personalization is becoming a core component of the digital experience

In an effort to enable hyper-personalization, organizations are adopting practices that prioritize customer-centric models, drive product innovation, and promote better practices across the value chain.

The success of and ROI on hyper-personalization are a function of the insurer’s digital initiatives across the value chain —leveraging capabilities such as AI, automation, machine learning; building a data ecosystem that elevates customer experiences. These technology enablers can help insurers better identify, engage with, and understand new and existing customer. To extract the most value from this approach, insurers need to employ dynamic growth strategies, and execute them with the help of third-party IT partners.

Industry :

Suzanne J. Dann

CEO - Americas 2

Suzanne Dann is Wipro's CEO for the Americas 2 region and is also a member of the Wipro Executive Board. She leads the Financial Services, Manufacturing, Energy and Utilities, and Hi-Tech sectors, as well as Wipro in Canada.

With over 25 years of experience in consulting and technology services, Suzanne has held multiple leadership positions at both IBM and Avanade. She joined Wipro in April 2021 as the Senior Vice President of Capital Markets and Insurance, successfully leveraging her deep industry expertise to deliver growth and build a high-performing team committed to client success. Suzanne also serves as the Executive Sponsor for Americas 2 Diversity and Inclusion initiatives.

Suzanne holds a B.S. degree in Engineering from Cornell University and a CISSP. She currently resides in New Jersey with her husband and their two children. In her free time she enjoys hiking, golf, and traveling with her family.