The importance of seamless customer onboarding has increased amid digital transformation.

Amid rapidly changing customer behavior, digital transformation in the banking industry is gaining strategic importance. Customers today expect enhanced experiences across the product lifecycle and are favoring the most convenient banking platforms. The prime causes of customer attrition are a lack of transparency and cumbersome operations.

In 2019, 78% of banks lost customers to digital-first competitors including non-banks and FinTechs. The pandemic has accelerated the adoption of digital channels, with digital-only customers now accounting for 41% of all US retail-banking customers compared to 30% a year ago. To keep pace with disruptive banking services and provide similarly seamless banking experiences, incumbents need to reconsider their current offerings and processes.

The first crucial step in the customer-bank relationship is customer onboarding. After evaluating multiple other options for their financial services needs, this is the customer’s first interaction with their chosen bank. The onboarding journey defines the level of trust customers will place on the bank not just for one product but for several other products and services in future.

Despite increased technology adoption in recent years, many banks still haven’t successfully digitalized customer onboarding. This is primarily due to numerous inefficiencies in the onboarding process from the perspective of both banks and their customers: a lack of mobile solutions, excessive paperwork and customer touchpoints, unprecedented delays, fragmented data, manual interventions, a lack of inter-departmental communication. The foremost reason for customer dissatisfaction tends to be repeated contacts and the need for regular document submissions. On average, a retail-banking customer is contacted ten times during the entire onboarding and is requested to submit documents in the range from five to one hundred times. In corporate banking, the friction is ever higher as onboarding can take three to nine weeks.

The global commercial banking market reportedly lost USD 3.3 trillion in one year due to abandoned onboarding applications. Banks need to view customers as partners and enhance their onboarding process to be reliable and frictionless to ensure sustainability. Customer onboarding also needs to be backed by a technology infrastructure that decentralizes the process and compliments the digital banking agenda of the bank. Decentralized customer onboarding processes will increase organizational agility, enabling banks to respond faster to the changing market conditions and remain competitive while maintaining sustainable customer relationship.

Maturity level of digital onboarding across banking products

A J.D. Power study shows the percentage of new account openings at bank branches dropped ten percentage points year over year “and now comprises just 55% of all new account openings.”

Digitization of the onboarding process has been an essential agenda for large US banks. In recent years, with consumers moving away from branch banking, banks have introduced partial digital onboarding services in select business lines and regions. As per Cornerstone Advisors, digital account opening (DAO) has been the most popular technology in banking since 2017. The J.D. Power study claims “31% of new account openings were executed through a bank website or mobile app” in 2020, “up from 22% in 2019.”

However, end-to-end digitalization of the onboarding journey across banking products is not yet standard, and for several products it does not exist at all. The maturity level of digital onboarding differs across banking products. Simple banking products such as retail checking accounts and credit cards are available digitally, but as the complexity of the product increases the onboarding process shifts toward manual, labor-intensive processes.

Product |

Digital Onboarding Capability |

|||

|---|---|---|---|---|

Existence |

Maturity Level |

|||

Checking Account |

High |

In the US, 64% of the checking account openings were done online in Q2 2020. |

Medium |

Large number of banks lack mobile solutions and have unwarranted customer touchpoints. |

Credit Cards |

High |

Digital onboarding platforms are available for disbursement with automated document verification and a decision-making module. |

Medium |

Limited customer segmentation, and virtual assistants lack personalization capabilities. |

Mortgages |

Medium |

Online mortgage initiation platform to help customers pre-qualify, book rates, submit documents and fill forms. A few banks provide enhanced data recognition tools that auto-fills the information leveraging existing relationships and from the documents already submitted. |

Low |

The digital mortgage application is limited to the website, and most large banks do not provide end-to-end digital application process, resulting in mandatory branch visits for closure. Errors noted in an online application process lead to reinitiating the onboarding process at a branch. |

Auto Loans |

Medium |

Most large banks provide online and mobile application for auto loans. However, there is a lack of integration with the dealers’ platform, resulting in customers switching platforms to finalize their purchase decision. |

Low |

In 2019, only 13% of US customers acquired their auto loan online. Most prefer their dealers’ financing options as it is a one-stop-shop for onboarding for the loan and purchase of products. |

Wealth Management |

Medium |

Digital options are available for existing customers comprising the selection of a type of account and broker, submission of documents, filling forms, and fetching account details. |

Medium |

New customers need to visit the branch to initiate an application. Online applications only mimic an in-person experience and lack ease of innovation in services. |

Figure 1: Existence and maturity level of digital onboarding across retail banking products; Source: Wipro Insights, Cornerstone Advisors, FICO

Key imperatives of ensuring a seamless onboarding process

Most banks are aware of the challenges in their onboarding process. However, the fear of non-compliance and the pressure to deliver on short-term targets takes banks’ attention away from the mammoth task of streamlining their current onboarding process across regions and product lines.

There is an immediate need for banks to rebuild their onboarding process in this highly competitive banking and financial services industry. Below are key considerations for banks undertaking this transformation:

Technologies that can elevate the onboarding experience

Despite the increase in virtual account openings, banks have only replicated in-branch onboarding to online versions; they have not yet automated or innovated the processes. Even among millennials, a demographic that prefers digital channels, 40% have given up online onboarding considering it a laborious process.

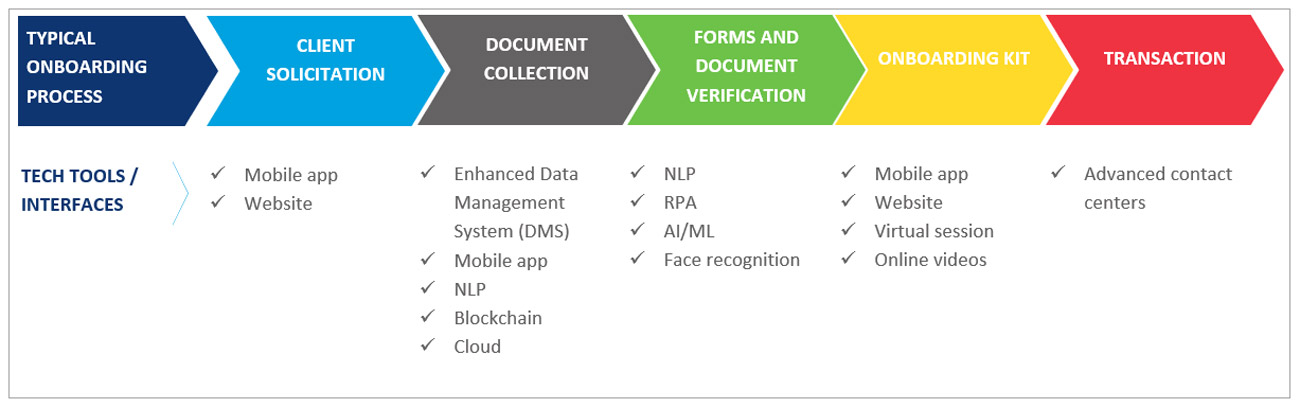

The efficient use of technologies and interfaces across the onboarding value chain can play a critical role in elevating the experience from only soliciting the client to the client using the product and services. In effect, banks can derive maximum benefits from their technology investments and maintain healthy relationships with clients.

Source: Wipro Insights

End-to-end digital onboarding is an opportunity to achieve a competitive edge

As digitalization in financial services takes center stage across all customer touchpoints, onboarding defines the longevity of the customer with the bank. FinTechs pose a threat to traditional banks because they tend to offer more convenience and better user experience. Banks need to redesign their current onboarding processes to be more customer-oriented and digital. More than adopting innovative technologies, banks need to ensure full integration with systems, functions, and processes. The current digital era offers enormous opportunity for innovation, but banks need to act fast and think holistically. To stay competitive, institutions need the capabilities to engage with and better understand their customers, and the flexibility to adapt with their changing needs. The onboarding experience is an important element of the customer relationship, and an ideal starting point for building a more resilient organization.

Mahesh G. Raja

Vice President & Sector Head — Banking and Financial Services, Americas

Mahesh leads Wipro’s Banking and Financial Services industry, supporting top-tier full-service banks, large payments, and FinTech clients across US and Canada with P&L responsibility. Leveraging Wipro’s digital, FinTech/new-age ecosystem Mahesh develops partnerships with leading FinTech players, helps clients assess the FinTech ecosystem and potential implications to their business, and delivers solutions to clients through alliances and implementation.

Supported By:

Shri Dhar (Senior Manager – Insights)

Radhika Todi (Assistant Manager – Insights)