Financial institutions have always needed to strike a balance between resiliency and growth, but their balancing act since 2020 has been unprecedented. What began with day-to-day operations being impacted by social distancing and lockdowns has evolved into optimizing distribution channels amid a macro-economic slowdown and more-sophisticated requirements from regulatory and investor communities. The resiliency measures that financial institutions unveiled, and continue to implement, for business and technology transformation will determine the “winners” of the next decade.

A strong case for utilities, more than ever before

Many organizations turned immediately to aggressive cost management as their default priority. Some instead looked to enhanced customer value as a strategic differentiator in those difficult times. As the industry continues to move forward, BPaaS cloud-based utilities should be a key consideration.

A utility is an entity that performs one or more common, non-differentiating functions in a standardized and efficient manner. Previously, these were carried out by the financial institutions themselves or a vendor, but in “silos.”

A prime and early example was a data utility company set up in 2015 through a collaboration between JP Morgan, Goldman Sachs, and Morgan Stanley. This utility cleaned reams of reference data more efficiently than the three individual firms could achieve alone. Over the years, utilities have taken on varied dimensions and forms, from a few players collaborating to industry-wide entities like SWIFT. Multiple models now span many countries, ranging from:

Regulators around the world have also been generally supportive of utilities and allowed compliance functions like “know your customer” (KYC) to be carried out by them. Apart from KYC and regulatory compliance, there are wide-ranging areas where the application of utility models has been tested. A few such domains are trading and execution, anti-money laundering solutions, and information exchanges to ward off cyber threats.

To date, most firms have looked at utilities only from a cost perspective. However, by ridding financial institutions of routine tasks, utilities can be a much more value-enhancing proposition and help the institutions to achieve:

However, financial institutions need to carefully analyze their process and workflows to identify areas most amenable to the utility model. Some key parameters of such identification are differentiating vs. non-differentiating capabilities, the repetitiveness of tasks, and whether it is a front-office or back-office function.

How can ‘Utility’ models help financial services firms drive forward?

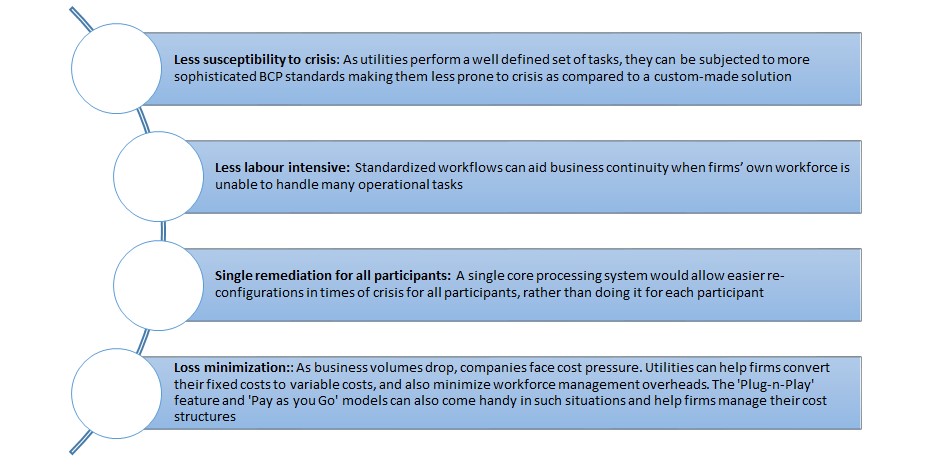

Utilities can clearly help in times of crisis, but their benefits are tangible even in “normal” times. Utilities enable financial institutions to simplify their architecture, streamline processes, and standardize and mutualize workflows aided by rapid advancements in cloud technology. These abilities can prove crucial in implementing advanced business continuity and contingency plans in numerous ways, like:

Engaging with utility service providers is one of the necessary actions in response to massive structural changes expected on multiple fronts — regulatory, macroeconomic, behavioral, and more. Companies can navigate such sweeping changes more efficiently if they work together with providers who can leverage their experience working with other financial institutions, thus ensuring a more robust presence.

However, before engaging vendors, firms should have clear visibility into their long-term business case and implementation roadmap. To that end, Wipro has developed several uses cases in this space:

The best time to act is now

Rapid change has been the name of the financial game during the past three years, and the way business is conducted continues to evolve. Financial institutions should maintain their focus on strengthening operational resilience, continue to accelerate their adoption of digital channels, and remain diligent in their support for a remote workforce and customer base. Growth in this new normal requires continued business and technological innovation. This includes executing on the industry utilities opportunity to enhance value delivery to customers and other stakeholders.

Harpreet Arora

VP & Head BFSI Consulting

Supported by: Kapil Kohli, Partner, and Dishank Jain, Senior Analyst – Wipro Insights

As a part of BFSI leadership team at Wipro, Harpreet has global responsibility for Overall Strategy, Consulting, Insights & Research and M&A supporting Wipro's global suite of clients in their transformation agenda. He brings experience across strategic insight, innovation, and transformation to a number of large, complex relationships, and has been instrumental in leading some of the large deals in the industry over his career.

Contact us