Two numbers tell the story of the pharmaceutical industry’s supply chain challenges. First, 168: the average number of days of inventory currently held by the 13 largest pharmaceutical/medical device companies. Second, 295: The number of active drug shortages in the US at the end of 2022 (a five-year high).

Pharmaceutical companies often rely on a very small group of suppliers to support multibillion-dollar products, so they must be rigidly conservative in their inventory management. Serious supplier issues could immediately put billions of dollars of revenue in jeopardy, and companies need to ensure they have built-in time cushions to support the lengthy new-supplier qualification process should a previous relationship go south. These homogenous supplier relationships have negative — but largely unnoticed — impacts on cashflow, innovation, cost, and resilience. And yet, clearly, this “strategic stockpiling” strategy is not solving the drug-shortage problem.

Instead of relying so heavily on stockpiling, pharmaceutical companies should explore new supply chain technologies to achieve diverse supply chains that are more agile, cost effective, and resilient. Integrating AI with technologies like IoT, blockchain, and optical character recognition (OCR) will enable pharmaceutical companies to rapidly onboard suppliers, monitor product quality in real time, and take a more data-driven approach to sourcing decisions. These new supply chain capabilities will allow pharmaceutical companies to finally embrace an ecosystem approach to sourcing, and even actively stimulate competition in the supplier market. Such an ecosystem would not only improve profitability across the industry, but also reduce costs to consumers and ultimately contribute to a more secure and disruption-proof health system.

Why a Broader Supplier Ecosystem?

Single-supplier products, regardless of industry, require companies to maintain large inventories as a risk-management strategy. Unfortunately, large inventories exert a significant drag on cashflow. Cashflow, in turn, provides the agility to quickly invest in promising new products — meaning that large inventories are also a drag on innovation. Even without this cashflow issue, a heavy reliance on individual suppliers makes supply chains more brittle and less resilient to regulatory, market, and geopolitical disruptions.

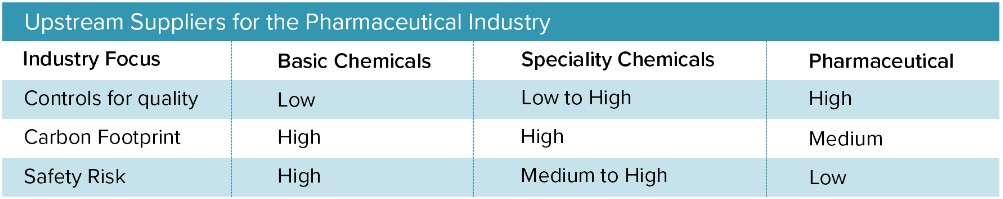

There is also a simple cost issue. For large suppliers of basic and specialty chemicals, the pharmaceutical industry is often a relatively minor revenue stream, which limits the industry’s buying power. At the same time, these suppliers know that the pharmaceutical business and operational model essentially locks companies into long-term supplier contracts, giving pharmaceutical companies little ability to leverage competition between suppliers. These costs are ultimately passed onto consumers.

Historically, pharmaceutical companies have largely relied on a small, concentrated pool of raw material suppliers, because it allowed them to bring drugs to market faster. A larger supplier ecosystem requires more experimentation, testing, and data tracking, all of which lengthen the path to commercialization. Also, researchers in pharma R&D highly prize consistency in terms of quality and yield, and it can be hard to convince them to qualify new sources.

Technology advancements remove many of the incentives for pharma companies to partner with a small and largely unchanging group of suppliers. In particular, advanced approaches to data will allow them to work with more supply chain partners at speed and scale, while also robustly supporting the quality needs of R&D teams.

Strategic Sourcing is the Future of Pharma Supply Chains

Achieving a more diverse and resilient supplier ecosystem will require a profound transformation of the pharmaceutical supply chain function.

The supply chain function is currently the data custodian for a pharmaceutical company. When a regulator needs data about the source and purity profile of a chemical used in a laboratory experiment nine years ago, the supply chain function is the ultimate holder of that data.

To enable a more rich, diverse, and competitive supplier ecosystem, pharmaceutical supply chain functions will need to become more than data custodians; they will need to use that data in service of strategic sourcing. In doing so, they will make profound advancements in four key areas:

1. Transparency

Detailed supply chain information is essential to prevent bad actors and noncompliant suppliers from infecting the long, complex, and expensive pharmaceutical product development cycle. On the downstream side, regulatory actions have forced pharma companies and distributors to adopt serialization. However, on the upstream side, much remains to be still done.

Pharma products have at times been severely impacted by upstream suppliers (see below) making minor changes in their processes and raw material sources. Any lack of transparency exposes pharma companies to costly risks, particularly if they fail to detect unsolicited changes or fail to predict the impact of detected changes quickly enough. On this front, blockchain solutions and real-time analytics on batch processing will revolutionize supply chain transparency. Blockchain and data automation will also make large multi-partner supplier ecosystems possible by dramatically simplifying data tracking. This traceability will ultimately create greater trust and security between global supply chain partners, pharmaceutical manufacturers, and consumers.

Locations

Locations