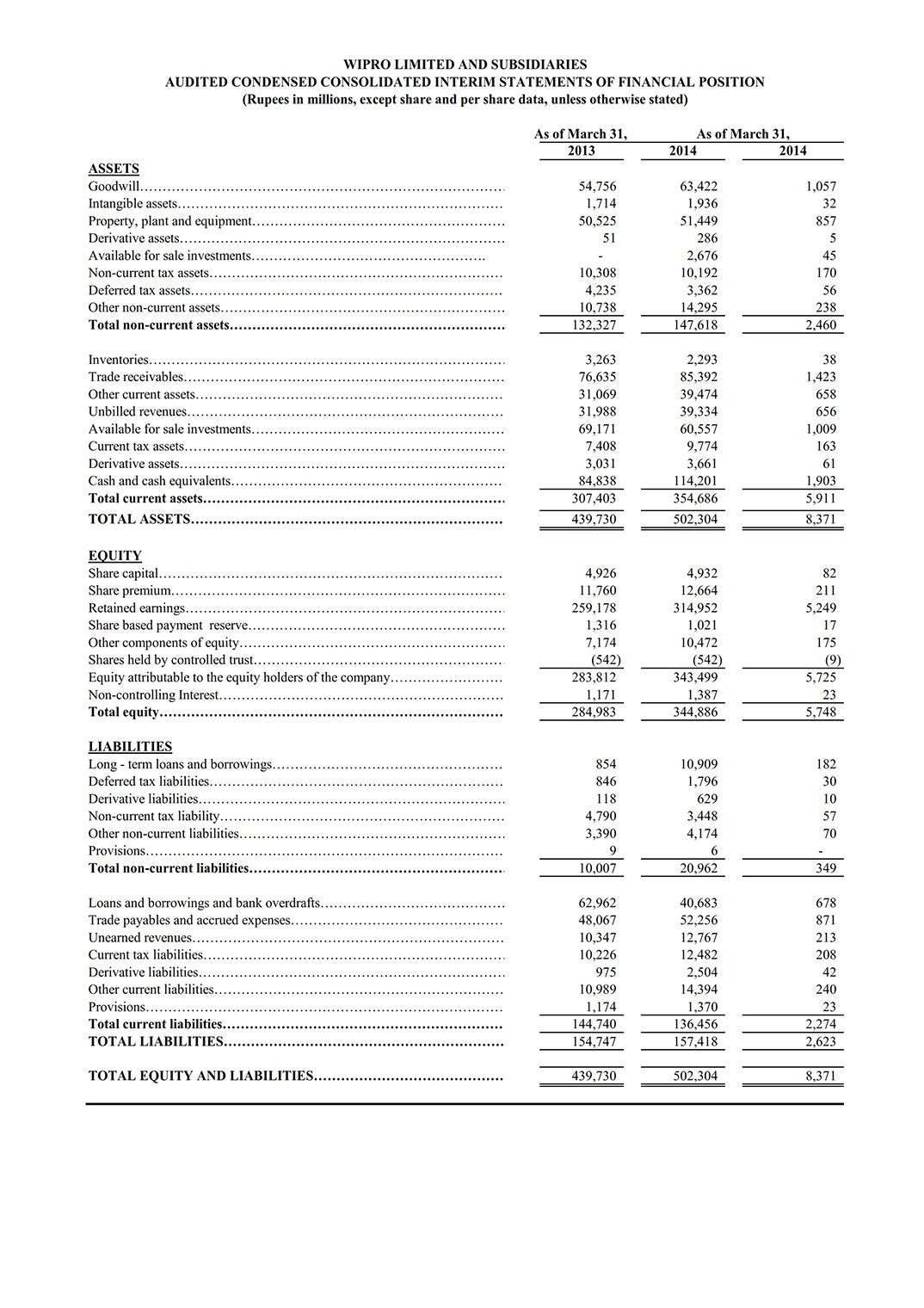

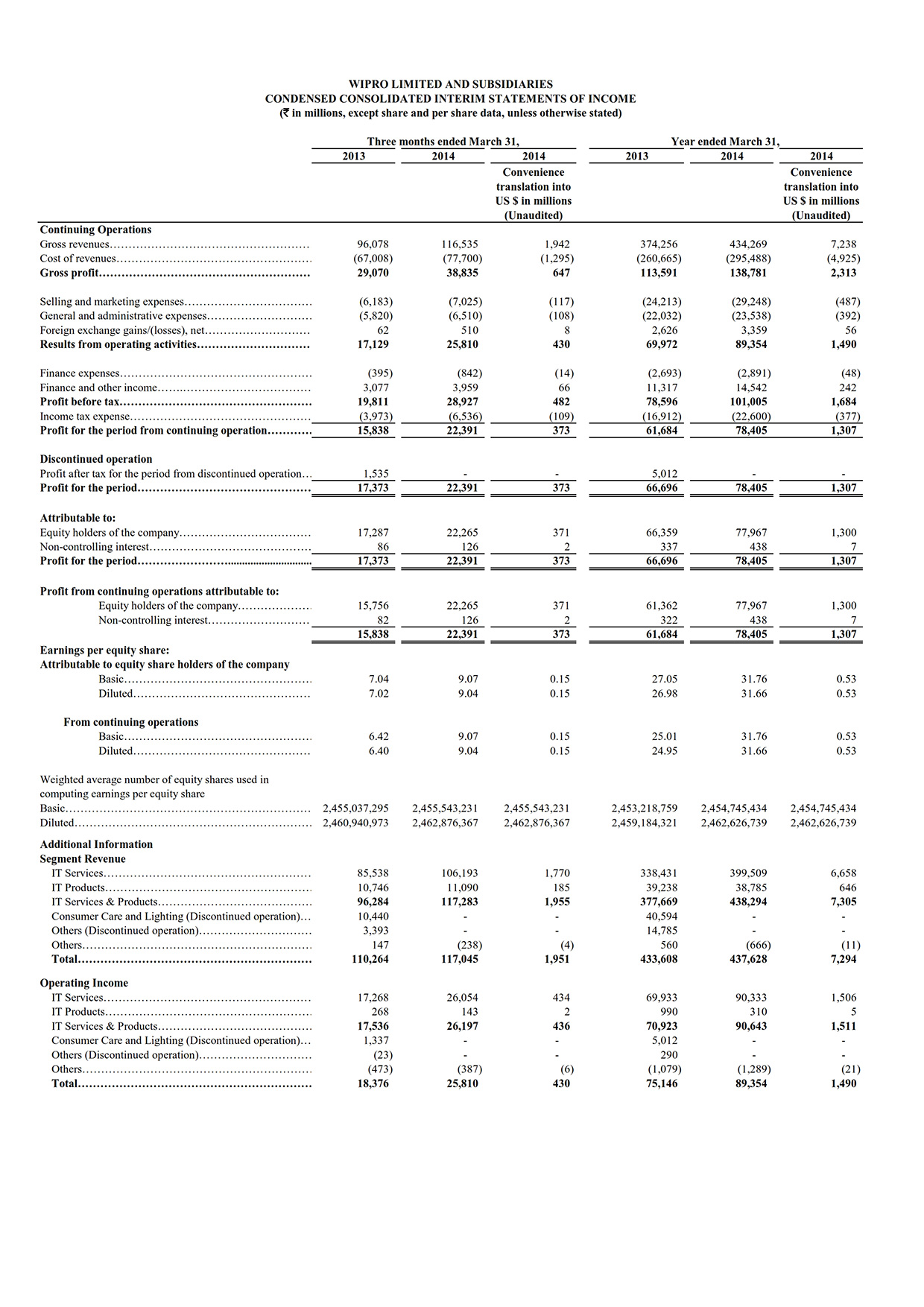

Bangalore, India and East Brunswick, New Jersey, USA – April 17, 2014 -- Wipro Limited (NYSE:WIT) today announced financial results under International Financial Reporting Standards (IFRS) for its fourth quarter and year ended March 31, 2014.

Highlights of the Results:

Results for the Quarter ended March 31, 2014:

Results for the Year ended March 31, 2014:

Performance for the quarter and year ended March 31, 2014

Azim Premji, Chairman of Wipro, commenting on the results said, “The steady improvement in global economy, coupled with the exciting pace of technological advancements, presents us with opportunities to create innovative solutions to help our customers differentiate, compete and succeed in their respective markets.”

T K Kurien, Executive Director & Chief Executive Officer of Wipro, said, “Our focus on process simplification, automation and platform-based delivery continues to deliver results and we are seeing the benefits through improved productivity, reduced timelines in execution and greater business agility. It is also gratifying to see that this focus has enabled improved win ratios and has also enhanced customer satisfaction.”

Suresh Senapaty, Executive Director & Chief Financial Officer of Wipro, said – “We continue to systematically work on improving our operational efficiencies resulting in expansion of full year IT Services operating margins by 195 basis points.”

Outlook for the Quarter ending June 30, 2014

We expect Revenues from our IT Services business to be in the range of $ 1,715 million to $ 1,755 million*.

* Guidance is based on the following exchange rates: GBP/USD at 1.66, Euro/USD at 1.37, AUD/USD at 0.90, USD/INR at 61.62

IT Services

The IT Services segment had 146,053 employees as of March 31, 2014. We added 59 new customers for the quarter.

Wipro has won a five-year infrastructure managed services contract with a Fortune 500 global leader in specialty chemicals. This strategic engagement leverages Wipro’s global network of data centers, delivery center footprint, automation capabilities and extensive experience in infrastructure and technology transformation. Wipro will incorporate ServiceNXT, its next-generation integrated managed services framework for this contract as well as leverage its strategic technology alliances in the industry.

Wipro has won a seven-year engagement with Xoserve, an organization which is an integral part of the restructured gas distribution market in Britain. The contract will involve replacement of Xoserve's two-decade old legacy platform with best-in-class enterprise applications and more contemporary technologies, which will enable Xoserve to better meet the expected demand growth generated by the roll-out of smart meters in the United Kingdom.

A large global bank has selected Wipro as a strategic partner to provide quality assurance and automation services. As part of this multi-year contract, services that are currently managed by multiple incumbent vendors will transition to Wipro. Wipro will also help establish a ‘Target Operating Model’ for software testing as well as provide functional and non-functional testing and automation services for the bank.

A leading apparel and footwear company has renewed its multi-year engagement with Wipro, for application support services in a managed services model. The services provided by Wipro will enhance the stability, resilience and reduce the total cost of ownership for the customer's organization-wide application landscape, which spans across several global brands and functions such as finance, supply chain, warehouse management and retail.

Wipro has won a deal from a multinational telecommunications company to manage IT and Network operations for their “Enterprise Business” in India. The scope of work includes design, build, feasibility, network operations and field support.

Wipro has won a large deal in the Basel II Risk & Compliance domain from a large state owned bank in India. The contract will provide Enterprise Risk Management for the Bank and its subsidiaries and will include the implementation of software, hardware, infrastructure management, and application sustenance.

Awards and accolades

Wipro was named ‘Leader’ in Worldwide Life Science Manufacturing and Supply Chain ITO by technology global research and advisory firm International Data Corporation (IDC) in its report IDC MarketScape: Worldwide Life Science Manufacturing and Supply Chain ITO 2013 Vendor Assessment, Doc #HI244265, November 2013. IDC evaluated leading Life Science Manufacturing and Supply Chain ITO Services providers across 24 criteria relating to current offering, strategy and market presence based on client inquiries, user needs assessments, and vendor and expert interviews.

IT Products

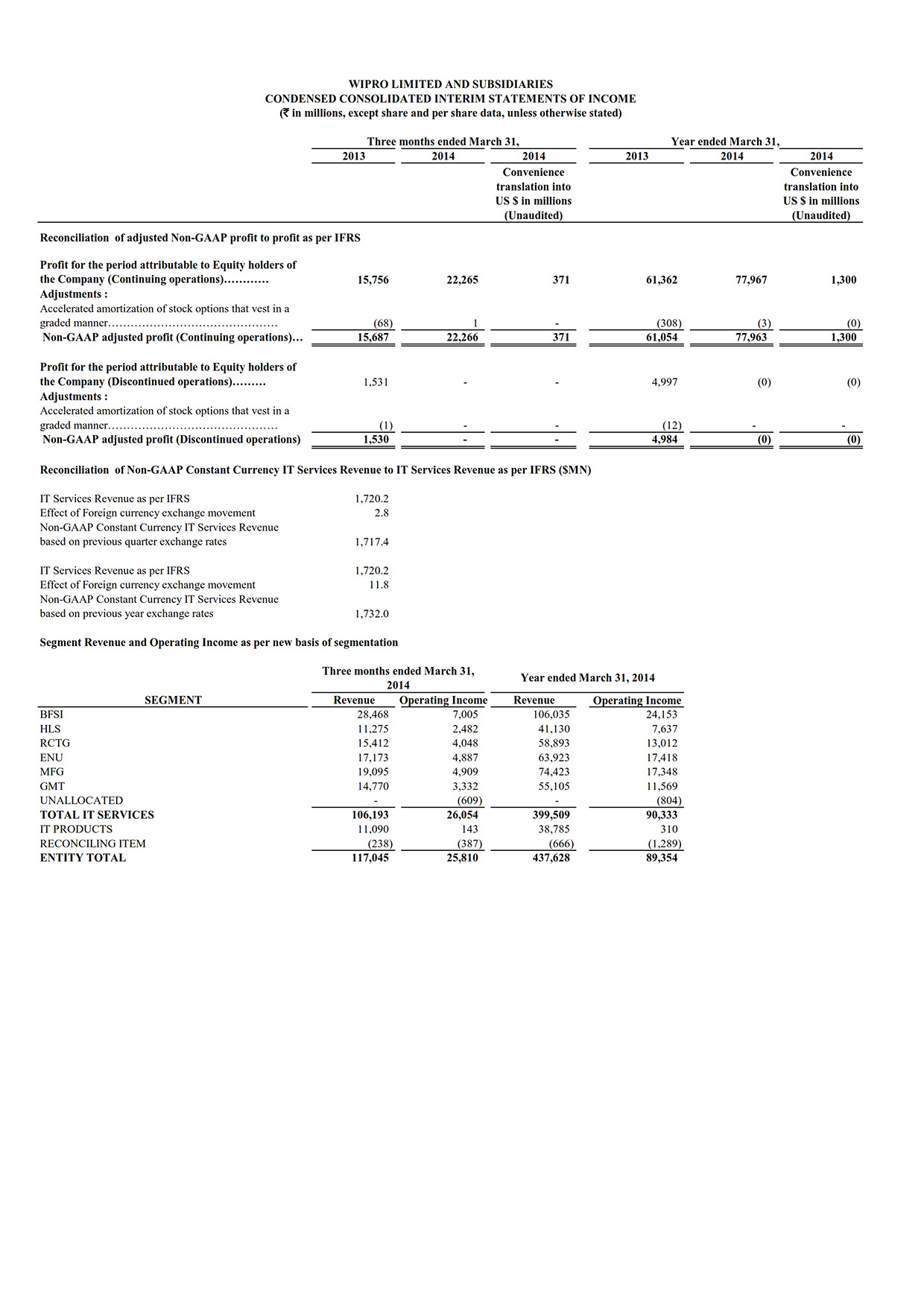

Please see the table on page 8 for a reconciliation between (i) IFRS Net Income and non-GAAP Adjusted Net Income (excluding the impact of stock-based compensation) and (ii) IFRS IT Services Revenue and IT Services Revenue on a non-GAAP constant currency basis.

About Non-GAAP financial measures

This press release contains non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that are adjusted to exclude or include amounts that are excluded or included, as the case may be, from the most directly comparable financial measure calculated and presented in accordance with IFRS.

The table on page 8 provides Adjusted Net Income for the period, which is a non-GAAP measure that excludes the impact of accelerated amortization in respect of stock options that vest in a graded manner, and IT Services Revenue on a constant currency basis, which is a non-GAAP measure that is calculated by translating IT Services Revenue from the current reporting period into U.S. dollars based on the currency conversion rate in effect for the prior reporting period. We consider a stock option award with a graded vesting schedule to be in substance a single award and not multiple stock option awards and accordingly believe the straight line amortization reflects the economic substance of the award. We refer to growth rates in constant currency so that business results may be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance. We believe that the presentation of this Non-GAAP Adjusted Net Income, when shown in conjunction with the corresponding IFRS measure, provides useful information to investors and management regarding financial and business trends relating to its Net Income for the period.

These Non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, the most directly comparable financial measure calculated in accordance with IFRS, and may be different from non-GAAP measures used by other companies. In addition to these non-GAAP measures, the financial statements prepared in accordance with IFRS and the reconciliation of these non-GAAP financial measures with the most directly comparable IFRS financial measure should be carefully evaluated.

For internal budgeting process, our management also uses financial statements that exclude the impact of accelerated amortization relating to stock options that vest in a graded manner. Management of the Company also uses Non-GAAP Adjusted Net Income, in addition to the corresponding IFRS measure, in reviewing our financial results.

Results for the quarter and year ended March 31, 2014, computed under IFRS, along with individual business segment reports, are available in the Investors section of our website at www.wipro.com.

Quarterly Conference Call

We will hold a conference call today at 06:45 p.m. Indian Standard Time (09:15 a.m. US Eastern Time) to discuss our performance for the quarter. An audio recording of the management discussions and the question and answer session will be available online and will be accessible in the Investor Relations section of our website at www.wipro.com.

About Wipro Limited (NYSE: WIT)

Wipro provides comprehensive IT solutions and services, including systems integration, Information Systems outsourcing, IT enabled services, package implementation, software application development and maintenance, and research and development services to corporations globally. Wipro Limited is the first PCMM Level 5 and SEI CMM Level 5 certified IT Services Company globally.

For more information, please visit our websites at www.wipro.com.

Contact for Investor Relations

Aravind V S

Phone: +91-80-25056186

aravind.viswanathan@wipro.com

Sridhar Ramasubbu

Phone: +1 408-242-6285

sridhar.ramasubbu@wipro.com

Contact for Media & Press

Vipin Nair

Phone: 91-80-3991-6154

vipin.nair1@wipro.com

Forward-looking and Cautionary Statements

The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, and its plans, expectations and intentions. Wipro cautions readers that the forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property, and general economic conditions affecting our business and industry. Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.

# # #

(Tables to follow)