IT services segment operating margin increases 40 bps QoQ.

Net income increases 5.2% QoQ.

FY 24 Large deal bookings at $4.6 billion, a YoY increase of 17.4%.

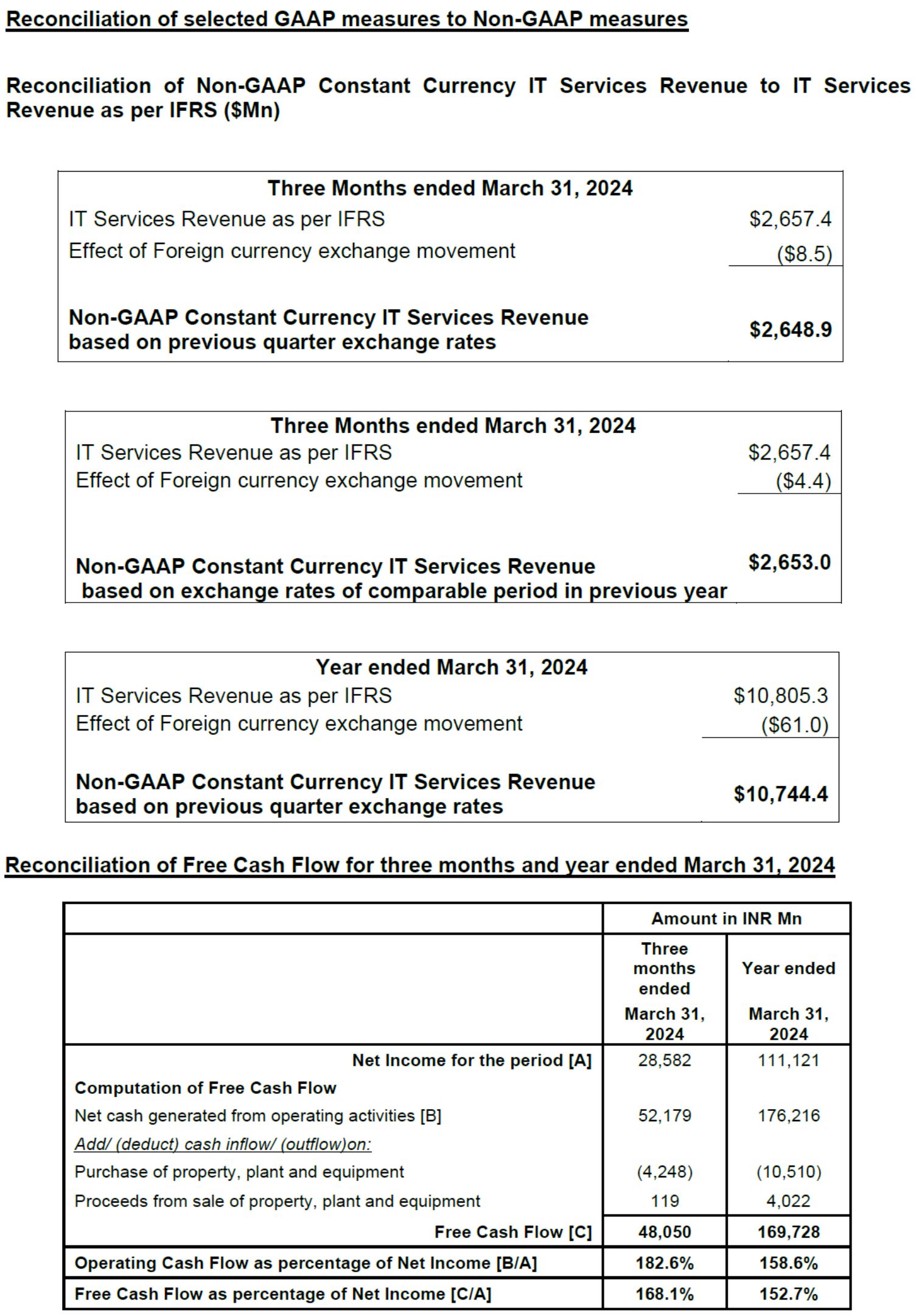

Operating cash flows at 158.6% of net income for the year.

EAST BRUNSWICK, N.J. | BANGALORE, India – April 19, 2024: Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO), a leading technology services and consulting company, announced financial results under International Financial Reporting Standards (IFRS) for the quarter and year ended March 31, 2024.

Highlights of the Results

Results for the Quarter ended March 31, 2024:

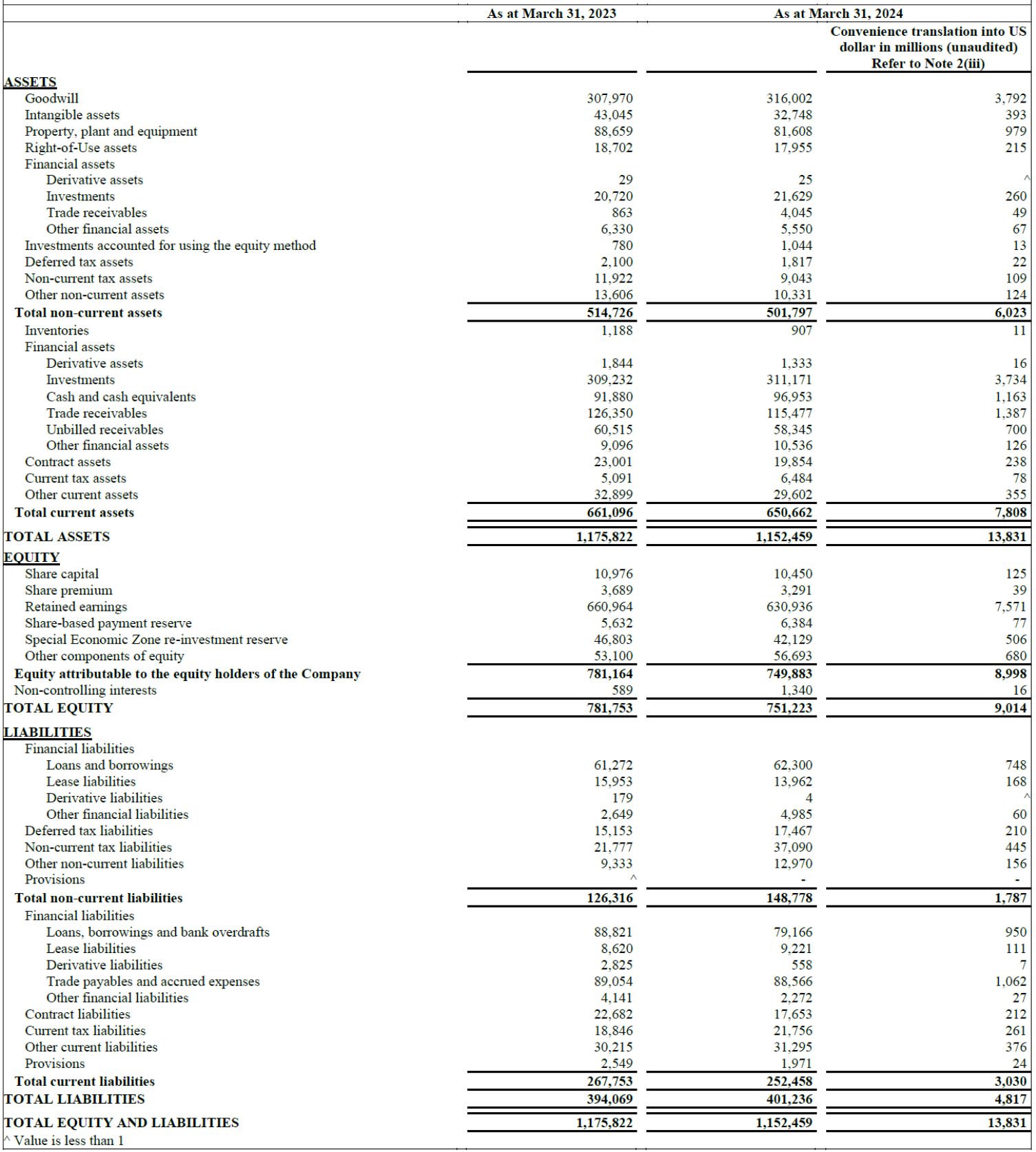

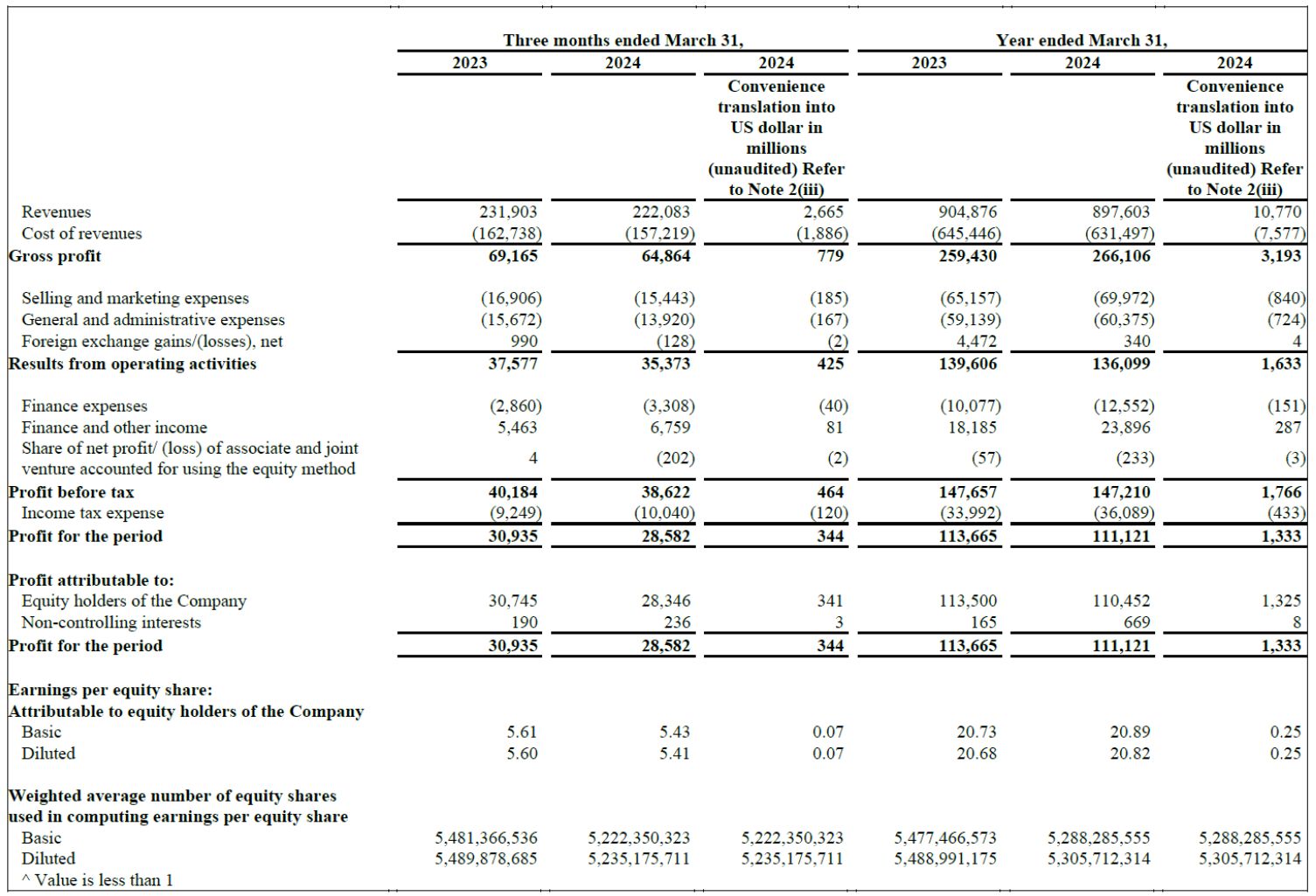

1. Gross revenue reached ₹222.1 billion ($2.7 billion1), flat QoQ.

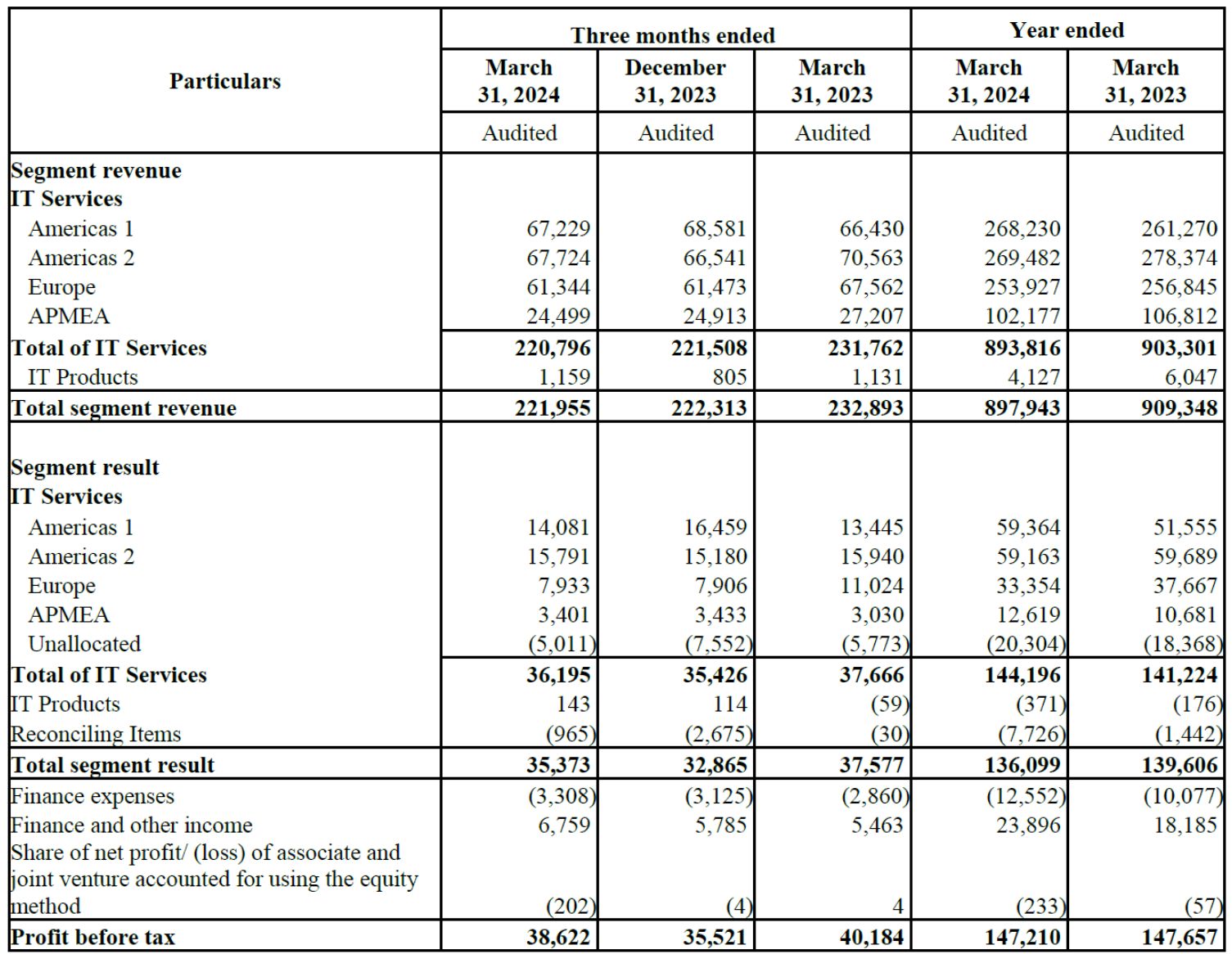

2. IT services segment revenue was at $2,657.4 million, an increase of 0.1% QoQ and decrease of 6.4% YoY.

3. Non-GAAP2 constant currency IT Services segment revenue decreased 0.3% QoQ, and 6.6% YoY.

4. Total bookings3 was at $3.6 billion. Large deal bookings4 was at $1.2 billion, increase of 31.1% QoQ and 9.5% YoY.

5. IT services operating margin5 for the quarter was at 16.4%, up by 40 bps QoQ.

6. Net income for the quarter was at ₹28.3 billion ($341.0 million1), an increase of 5.2% QoQ.

7. Earnings per share for the quarter was at ₹5.43 ($0.071), an increase of 5.2% QoQ.

8. Operating cash flows of ₹52.2 billion ($626.1 million1), an increase of 9.0% QoQ and at 182.6% of Net Income for the quarter.

9. Voluntary attrition was at 14.2% on a trailing 12-month basis.

Results for the Year ended March 31, 2024:

1. Gross revenue reached ₹897.6 billion ($10.8 billion1), a decrease of 0.8% YoY.

2. IT services segment revenue was at $10,805.3 million, a decrease of 3.8% YoY.

3. Non-GAAP2 constant currency IT Services segment revenue decreased 4.4% YoY.

4. Large deal bookings4 was at $4.6 billion, up by 17.4% YoY. Total bookings3 was at $14.9 billion decrease of 5.5% YoY.

5. IT services operating margin5 for the year was at 16.1%, up by 50 bps YoY.

6. Net income for the year was at ₹110.5 billion ($1,325.3 million1), a decrease of 2.7% YoY.

7. Earnings per share for the year was at ₹20.89 ($0.251), an increase of 0.8% YoY.

8. Operating cash flows of ₹176.2 billion ($2,114.0 million1), an increase of 34.9% YoY and at 158.6% of Net Income for the year.

Outlook for the Quarter ending June 30, 2024

We expect revenue from our IT Services business segment to be in the range of $2,617 million to $2,670 million*. This translates to sequential guidance of (-)1.5% to +0.5% in constant currency terms.

* Outlook for the Quarter ending June 30, 2024, is based on the following exchange rates: GBP/USD at 1.26, Euro/USD at 1.08, AUD/USD at 0.66, USD/INR at 83.19 and CAD/USD at 0.74

Performance for the Quarter and Year ended March 31, 2024

Srini Pallia, CEO and Managing Director, said “FY24 proved to be a challenging year for our industry, and the macroeconomic environment remains uncertain. However, I am optimistic about the opportunities that lie ahead. We are on the brink of a major technological shift. Artificial intelligence is transforming our clients’ needs as they seek to harness its power for competitive advantage and enhanced business value. At Wipro, we have been gearing up for this moment. We have the capabilities, leadership, and the strength of over 230,000 Wiproites around the world to help us realize our goals. Although there’s a considerable amount of work ahead of us, I am confident that together, with our collective effort, we can pave the way for the next chapter of growth.”

Aparna Iyer, Chief Financial Officer, said “We expanded our margins by 40 basis points during the quarter resulting in EPS growth of 5.2% QoQ in Q4. Despite a challenging macro-environment our IT services margin expanded by 50 basis points for the full year FY24. We generated highest operating cash flow in recent years which is at 183% of our net- income in Q4 and 159% on a full year basis.”

Capital Allocation:

The Board of Directors confirmed the interim dividend of ₹1 declared by the Board earlier at its meeting held on January 12th, 2024, shall be considered as the final dividend for the financial year 2023-24.

1. For the convenience of the readers, the amounts in Indian Rupees in this release have been translated into United States Dollars at the certified foreign exchange rate of US$1 = ₹83.34, as published by the Federal Reserve Board of Governors on March 31, 2024. However, the realized exchange rate in our IT Services business segment for the quarter ended March 31, 2024, was US$1= ₹83.09

2. Constant currency for a period is the product of volumes in that period times the average actual exchange rate of the corresponding comparative period.

3. Total Bookings refers to the total contract value of all orders that were booked during the period including new orders, renewals, and increases to existing contracts. Bookings do not reflect subsequent terminations or reductions related to bookings originally recorded in prior fiscal periods. Bookings are recorded using then-existing foreign currency exchange rates and are not subsequently adjusted for foreign currency exchange rate fluctuations. The revenues from these contracts accrue over the tenure of the contract. For constant currency growth rates, refer note 2.

4. Large deal bookings consist of deals greater than or equal to $30 million in total contract value.

5. IT Services Operating Margin refers to Segment Results Total as reflected in IFRS financials.

6. Voluntary attrition is in IT Services computed on a quarterly annualised basis and excludes DOP.

7. Effective April 1, 2023, we merged our ISRE segment with our IT Services segment. The YoY growth rates for the quarter ended March 31, 2024 were computed by rebase lining Q4’23 numbers.

Highlights of Strategic Deal Wins

In the fourth quarter, Wipro continued to win large and strategic deals across industries. Key highlights include:

1. A multinational healthcare and insurance organization has selected Wipro to transform its technology-enabled health services business to increase adoption of value-based care and enhance member experience. Wipro will help the client re-imagine its end-to-end member, patient, and provider journey by building a standardized, interoperable, and integrated care delivery platform. Overall, the project will improve talent allocation and care coordination by leveraging GenAI. It will also reduce costs and improve the quality of healthcare.

2. Wipro was selected by a US-based health information technology company to scale their Release of Medical Information business that covers over 2,000 hospitals and 15,000 clinics in the country. Wipro will deploy automation-enabled workflows to ensure seamless patient data handling, allowing the client to create new efficiencies and expand its business.

3. A major US-based health insurance provider for government-sponsored health programs selected Wipro as its technology and operations transformation partner. Leveraging its proprietary Medicare Advantage platform, Wipro will offer the client an AI-driven, modular member enrolment platform, which will streamline business operations. The project will lead to reduced operating expenses, improved compliance and STAR rating of its products, and enhanced member experience.

4. A leading US-based telecom wireless operator has selected Wipro as a strategic partner to provide managed services and overhaul the client’s IT and digital operations. As part of this deal, Wipro will implement and operate a leading IT SaaS operating platform across the organization, drive data driven insights, enhance digital and billing operating platforms, and drive better security and quality engineering practices.

5. A large omnichannel lifestyle retailer in Brazil has awarded Wipro a multi-year deal to modernize and transform its operations to support its strong growth ambitions. In a first of its kind in the region, Wipro will migrate the client's retail landscape, including the merchandising and planning modules, to a cloud-based platform, creating a more agile, resilient, and efficient system. This will drive increased productivity, reduce costs, and support the client’s sustainability goals.

6. A US-based multinational department store has selected Wipro to develop an automation framework that will help the client streamline and improve its business processes and systems. Through this engagement, Wipro will help the client identify inefficiencies and enable continuous improvement of business system features. Wipro will also conduct ongoing performance testing to ensure a seamless user experience and enhance customer satisfaction. This will lead to a 20% improvement in time to market, supporting the client’s market expansion across brick-and-mortar and online stores.

7. A leading US-based technology company has selected Wipro to provide integrity and labelling services for its platforms and tools. Wipro will deploy its trained data experts to review and label large volumes of content and accelerate turnaround times to meet the client’s changing business needs. Wipro teams will improve the accuracy and precision of data, thereby enhancing the client’s GenAI/machine learning algorithm.

8. A US-based regional bank has selected Wipro to deliver a multi-faceted transformation across their ecosystem. This multi-year engagement will include cloud and data, cyber security, and infrastructure to deliver enhanced business value to their customers. These programs will enable the client to increase operational efficiency, achieve a better cybersecurity posture, and a faster time to market.

9. An American bank has selected Wipro to setup a near shore bi-lingual alert monitoring unit to enhance their anti-money laundering operations. Wipro has been selected for their exceptional quality, efficient and scalable delivery model, and proven track record in the financial crime compliance space.

10. A US-based bank and financial services company has selected Wipro to digitally transform their business. Wipro will support integration of new technology initiatives centered on modernizing existing business applications, processes, and data management. This multi-year technology transformation will support the client’s growth strategy and accelerate their goal of becoming a full-service bank.

11. Wipro was selected by a Singapore government agency for its finance digitization and cloud transformation program. Wipro will maintain and drive product upgrades to process daily transactions seamlessly. This will enhance the user experience and provide the client with a 360-degree view of interactions. Wipro will also rationalize and consolidate the client’s IT services for business-critical Corporate and Enterprise applications on a fully digital platform. This will enable greater productivity, enhance efficiency, and improve effectiveness for the client, thereby accelerating their digital transformation journey.

12. A European-based bicycle manufacturer selected Wipro to manage their entire integrated IT landscape. The Wipro team will run everything from their customer-facing digital tower to all back-end and IT applications. Wipro will also transform and run the client’s core infrastructure, including complete cyber security operations and their entire data backbone. This multi-year engagement will lead to streamlined, consolidated, and synchronized IT processes, boosted cybersecurity, elevated customer experience, and reduced costs.

13. A German global automotive parts manufacturer selected Wipro to transform their IT back-end systems into a hybrid cloud-based solution. The solution will enable the client to standardize and digitize their back-end ecosystem while increasing their cybersecurity posture. The client will be more agile and resilient as a result of the project.

14. A global insurance broker has selected Wipro to unify and scale its business. Wipro will digitize and streamline the client’s bid, product, and onboarding processes across multiple geographies. The project will integrate the client’s customer relationship management solutions into their broader technology estate using a templatized platform-based approach with Salesforce & MuleSoft. The team will also provide continuous platform evolution and business support. The project will enable a more cohesive business and technology landscape, leading to better efficiencies, an improved customer experience, and new growth opportunities.

Analyst Recognition

1. Wipro was named a Leader in The Forrester Wave™: Application Modernization and Migration Services, Q1 2024

2. Wipro was named as a Leader in IDC MarketScape: Worldwide Blockchain Services 2024 Vendor Assessment (Doc # US49434623 Feb 2024)

3. Wipro was positioned as a Leader in ISG Provider Lens™ - Sustainability and ESG 2023 (all quadrants)

4. Wipro was rated as a Leader in ISG Provider Lens™ Healthcare Digital Services 2023 (all quadrants)

5. Wipro was recognized as a Leader in ISG Provider Lens™ Oracle Cloud and Technology Ecosystem 2023 (all quadrants)

6. Wipro was classified as a Leader in ISG Provider Lens™ - Intelligent Automation – Services and Solutions 2023 (multiple quadrants)

7. Wipro was featured as a Horizon 3 - Leader in HFS Horizons: Assuring the Generative Enterprise™, 2024

8. Wipro was recognized as a Leader in Everest Group's Application Transformation Services PEAK Matrix® Assessment 2024 – North America & Europe

9. Wipro was designated as a Leader in Avasant's Hybrid Enterprise Cloud Services 2023-2024 RadarView™

10. Wipro was named as a Leader in Avasant's SAP S/4HANA Services 2023-2024 RadarView™

11. Wipro was positioned as a Leader in the 2024 Gartner® Magic Quadrant™ for Outsourced Digital Workplace Services

Source & Disclaimer: *Gartner, “Magic Quadrant for Public Cloud IT Transformation Services”, Mark Ray, et al, 16 August 2023.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product, or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner's research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this [type of filing]), and the opinions expressed in the Gartner Content are subject to change without notice.

IT Products

1. IT Products segment revenue for the quarter was ₹1.2 billion ($13.9 million1)

2. IT Products segment results for the quarter were ₹0.14 billion ($1.72 million1)

3. IT Products segment revenue for the year was ₹4.1 billion ($49.5 million1)

4. IT Products segment results for the year were (-₹0.37 billion) (-$4.45 million1)

Please refer to the table on page 12 for reconciliation between IFRS IT Services Revenue and IT Services Revenue on a non-GAAP constant currency basis.

About Key Metrics and Non-GAAP Financial Measures

This press release contains key metrics and non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that are adjusted to exclude or include amounts that are excluded or included, as the case may be, from the most directly comparable financial measure calculated and presented in accordance with IFRS.

The table on page 12 provides IT Services Revenue on a constant currency basis, which is a non-GAAP financial measure that is calculated by translating IT Services Revenue from the current reporting period into U.S. dollars based on the currency conversion rate in effect for the prior reporting period. We refer to growth rates in constant currency so that business results may be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance. Further, in the normal course of business, we may divest a portion of our business which may not be strategic. We refer to the growth rates in both reported and constant currency adjusting for such divestments in order to represent the comparable growth rates.

Our key metrics and non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, the most directly comparable financial measure calculated in accordance with IFRS and may be different from non-GAAP measures used by other companies. Our key metrics and non-GAAP financial measures are not comparable to, nor should be substituted for, an analysis of our revenue over time and involve estimates and judgments. In addition to our non-GAAP measures, the financial statements prepared in accordance with IFRS and the reconciliation of these non-GAAP financial measures with the most directly comparable IFRS financial measure should be carefully evaluated.

Results for the Quarter and Year ended March 31, 2024, prepared under IFRS, along with individual business segment reports, are available in the Investors section of our website www.wipro.com/investors/

Quarterly Conference Call

We will hold an earnings conference call today at 07:00 p.m. Indian Standard Time (9:30 a.m. U.S. Eastern Time) to discuss our performance for the quarter and the year. The audio from the conference call will be available online through a webcast and can be accessed at the following link-

https://links.ccwebcast.com/?EventId=WIP190424

An audio recording of the management discussions and the question-and-answer session will be available online and will be accessible in the Investor Relations section of our website at www.wipro.com

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading technology services and consulting company focused on building innovative solutions that address clients’ most complex digital transformation needs. Leveraging our holistic portfolio of capabilities in consulting, design, engineering, and operations, we help clients realize their boldest ambitions and build future-ready, sustainable businesses. With over 230,000 employees and business partners across 65 countries, we deliver on the promise of helping our clients, colleagues, and communities thrive in an ever-changing world. For additional information, visit us at www.wipro.com

Forward-Looking Statements

The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, the benefits its customers’ experience and its plans, expectations, and intentions. Wipro cautions readers that the forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, complete proposed corporate actions, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property and general economic conditions affecting our business and industry.

Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.

Additional Information:

Effective April 1, 2023, we merged our India State Run Enterprise segment (“ISRE”) with our IT Services segment. Currently, the Company is organized into the following operating segments: IT Services and IT Products.

IT Services: As announced on November 12, 2020, effective January 1, 2021, we re-organized our IT Services segment into four Strategic Market Units (“SMUs”) - Americas 1, Americas 2, Europe and Asia Pacific Middle East Africa (“APMEA”).

Americas 1 and Americas 2 are primarily organized by industry sector, while Europe and APMEA are organized by countries.

Americas 1 includes Healthcare and Medical Devices, Consumer Goods and Lifesciences, Retail, Transportation and Services, Communications, Media and Information services, Technology Products and Platforms, in the United States of America and entire business of Latin America (“LATAM"). Americas 2 includes Banking, Financial Services and Insurance, Manufacturing, Hi-tech, Energy and Utilities industry sectors in the United States of America and entire business of Canada. Europe consists of United Kingdom and Ireland, Switzerland, Germany, Benelux, Nordics and Southern Europe. APMEA consists of Australia and New Zealand, India, Middle East, South East Asia, Japan and Africa.

IT Products: The Company is a value-added reseller of desktops, servers, notebooks, storage products, networking solutions and packaged software for leading international brands. In certain total outsourcing contracts of the IT Services segment, the Company delivers hardware, software products and other related deliverables. Revenue relating to the above items is reported as revenue from the sale of IT Products.