1.0 Abstract

Digital is the new Black. It seems to have taken over our lives, both personal and professional - smartphones, tablets, eBooks, digital newspapers, digital storefronts, doctors tweeting from operation theatres, digital ecosystems in our living rooms, digital notes, mobile commerce, digital media libraries, digital payments and even digital supply chains! This transformation has been set in motion by a greater adoption of the internet by the general public on a global scale, which has forced organizations to develop e-commerce strategies and incorporate the multi-channel approach into their business models. The number of internet users has increased dramatically over the past two decades. From 16 million internet users which accounted for 0.4% of world population in 1993, the figure has increased to over 2.7 billion people in 2013 which corresponds to 39% of the world’s population. Mobile-broadband subscriptions have climbed from 268 million in 2007 to 2.1 billion in 2013. This reflects an average annual growth rate of 40%, making mobile broadband the most dynamic ICT (Information and communication technology) market1

Organizations are fast aligning themselves to keep pace with this transformation. From Digital Lines of Businesses to optimize product service/development & mobile first product strategies, to Digital marketing, every function in the organization is getting a makeover in an attempt to reach out to today's connected consumer. Assurance though is still being looked at in silos with emphasis on “testing” an application or a channel. Testing for new world realities continues to be “best-effort” and at the mercy of ever shrinking IT budgets, resulting in inconsistent customer experience across channels, loss of market, and negative brand perception.

What organizations need to realize is that a holistic assurance strategy not only ensures successful digital transformation but can also help in optimizing IT budgets. This whitepaper will walk you through the key considerations for such a strategy and will help you answer the following questions - What are the various points of assurance to be considered in a digital strategy? What are the enablers you can use for leveraging process efficiencies? Which tools and strategies should be employed to validate the technology used?

2.0 Points of Assurance - Challenges of a Digital Organization vs Needs of a Connected Consumer

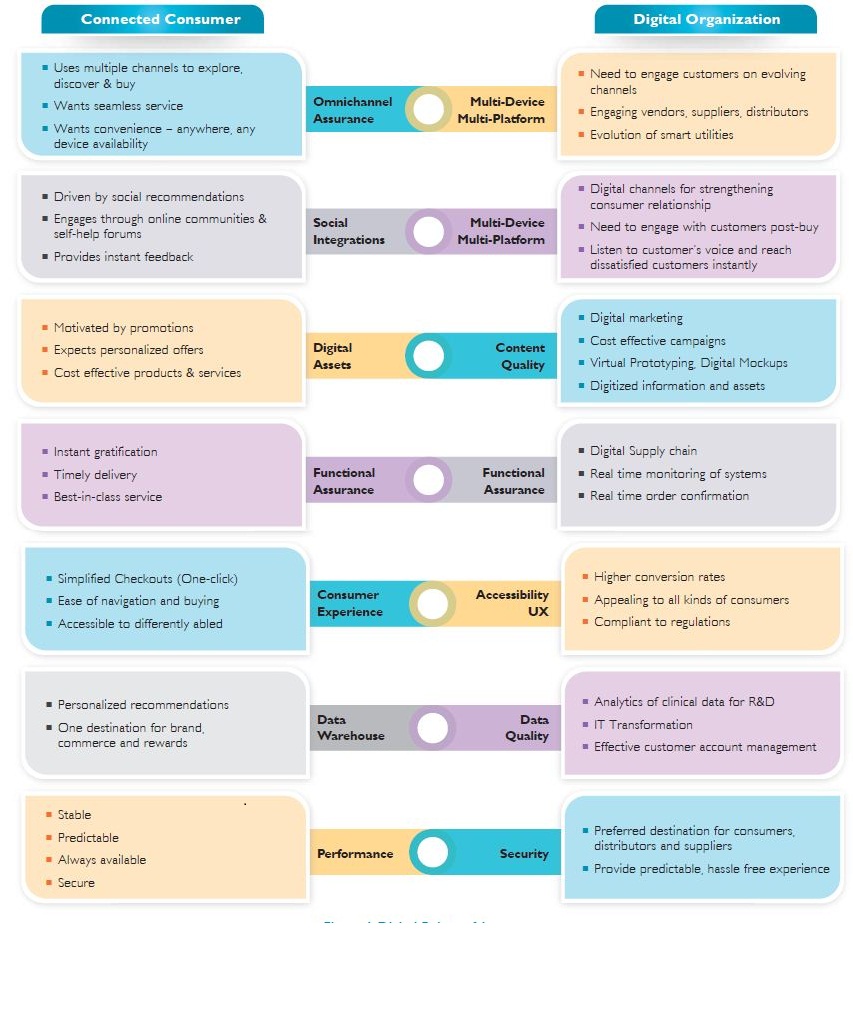

Digital has evolved from being just another channel to becoming “the preferred” channel for both consumers and organizations. The intersection of the needs of today’s Digital Consumer and challenges for a Digital organization throws up common Points of Assurance (PoA) to be considered

Figure 1 Digital Points of Assurance

To better understand Points of Assurance, let us consider a real world scenario of a user looking to buy a product on the web:

3.0 Points of Assurance – Key Considerations

Each of the above aspects has its own nuances to be considered for a robust digital assurance strategy. Here are few pointers on how to approach each of these and also identify opportunities to optimize:

3.1 Omni - channel Assurance

Digital assurance strategy should focus on optimizing functional testing across channels. It is more likely to mimic a user’s behavior in today’s world where a customer browses for a product on the web, adds to a cart on a mobile device, completes the purchase on the web again and picks up the product in the store. An end-to-end regression strategy with test scenarios spread across channels (and not repeat regression for each channel) can save upto 30% of efforts and resembles user behavior closely. Remember, consolidating testing across channels in not Omni-channel testing. Designing a test strategy with a view of all the channels and real user behavior is!

3.1.1 Users on multiple devices

With proliferation of devices, a new category seems to be originating every now and then. From phone to tablets to phablets to ultra-books, every new category brings with it the nuances of ensuring that the applications run fine on each of the devices in each of the categories. Smartphones accounted for 51.8 percent of mobile phone sales in the second quarter of 2013, with a growth of 46.5%, resulting in smartphone sales surpassing feature phone sales for the first time – Gartner (Aug 2013)2. In spite of this, according to a research conducted by Interactive Advertising Bureau, 45% of Fortune 500 enterprises lack fully Mobile-Optimized corporate websites, due to the steep costs associated with implementation on a wide range of mobile devices. A digital assurance strategy should build in Risk-Based sampling strategies across devices and also employ automation for repeated tests on various devices3

3.1.2 Users on multiple platforms

Given the rate at which a new combination keeps getting added with every new version of a browser (browser wars) or OS getting introduced, it is not only important to ensure testing is done on all possible browsers and operating system stacks, but it is also necessary to optimize testing across these combinations by using statistical sampling methods and automation framework to reuse tests

3.2 Users in multiple geographical locations

3.2.1 Enable Multivariate testing

Organizations would want to test for multivariate behavior to seek feedback on instances getting most attention or to market different promotions based on geography. Digital assurance should focus on optimizing tests along with automation, to reduce effort in functional validation of multiple instances of application

3.2.2 Localization testing

Internet users are spread worldwide with Asia accounting for 44.8% of internet users, followed by Europe (21.5%), North America (11.4%), Latin America (10.4%), Africa (7%), Middle East (3.7%) and Oceanic (1%).

The top ten languages i.e. English, Chinese, Spanish, Japanese, Portugese, German, Arabic, French, Russian and Korean account for 81% of the world internet users.4 Are the users, spread across different geographies and cultures, speaking different languages finding the same functionality, similar semantics or more holistically perceiving the same brand experience? A digital assurance strategy should include testing for Localization and Globalization as well

3.2.3 Performance

Performance tests emulating users across geographies – To model real-time behavior, tests should take in to consideration the load pattern distribution across the geography

3.3 Functional validation of end-to-end Business Scenarios

By far the most important aspect in the entire assurance strategy is to ensure that an application is validated against Business expectations & functionality, as documented by the Business Process Models. Does the strategy require involvement of the Digital BAQAs (Business Analysts and Quality Assurance engineers) early in the ideation phase? Does it include creation of Business Test scenarios based on business processes beyond the functional test cases? It is important to have the right answer to these questions to ensure the recommendation engine is working right and the promotions are visible at all the right places, along with the shipping calculator working right with the new free shipping promotion for certain categories

3.4 Customer Experience and Social Integration

The digital assurance strategy needs to be guided by User experience and uniform brand experience goals: Colors, grids, layout, positioning of labels & buttons, fonts, fat finger testing & number of user hops are all considerations one must test to ensure a good user experience and uniform brand experience irrespective of the channel the customer uses.

Ford was one of the pioneers in the automobile industry to realize the potential of engaging customers through social media which was evident in the way they went about promoting their Fiesta model over social media almost 18 months before reentering the US subcompact car market. One of the initiatives was to award 100 social media influencers with the car and asking them to complete a set of tasks and to document their experience across various social channels. The result was astounding with more than 6.5 million views on YouTube and more than 50,000 requests generated from non-Ford drivers5. In an increasingly social world, the ability of users to seamlessly share can directly and many a times instantly influence organizational success or failure. Recently, McKinsey Company released data which indicated that one of their telecom clients suffered an 8% loss in sales based upon negative sentiments in the social media space. In another recent survey6 71% of executives surveyed rated social media as one of the technology trends, having a significant impact on their business along with mobile and online shopping assurance strategy needs to take in to consideration social integration across channels. Digital assurance in the social world needs to go beyond the traditional boundaries of testing. Does the organization’s assurance strategy take in to account what’s being said in the social world about a brand and its digital readiness while testing for user experience? Does it validate an organization’s social media strategy?

3.5 Assurance for Digital Assets and Content Quality

From digital brochures for marketing, to digital products requiring a secure digital supply chain and voluminous digital content for web, digital assets can be of varying types. Does the organization have a robust Enterprise Content Management strategy? Are digital assets catalogued right? Is there a quality assurance checklist for digital properties to ensure consistency and standards across sites? Is the content validation process and workflow standardized to reduce review cycles with creative agencies and asset review teams and increase overall quality?

3.6 Security Assurance

Applications managed by organizations are ever increasing (running in to thousands); from increasingly diverse sources (built in-house, COTS, SaaS) and hosted on multiple platforms (in-house network, cloud, web, mobile). This has raised the risk profile necessitating security testing across all these potential vulnerabilities, focusing on application profiling, authentications, authorizations, session management, data validation and encryption algorithms. Security assurance strategies can range from Vulnerability assessments to Penetration testing

3.7 Lifecycle Automation

Continuous Delivery and Agility: Assurance for the multitude of channels, devices and platforms, frequent iterations for churning out builds with new features can be cost and time-intensive without a right automation framework. Traditional automation approaches of – Design a scenario, build the software, write a test and then automate, can only mean high maintenance and little ROI. Consider automating the entire life cycle with continuous integration tools, behavioral automation frameworks and business process testing methodologies. What if you can generate automated test cases right from your business processes? What if these can be triggered automatically on a code check-in and can generate a report for you to see without any manual intervention? A large retailer was able to successfully cut down release cycle time (from 3 months to a 15-day release cycle) by revamping their development & build strategy, adopting continuous integration approach and virtualizing a lot of environment requirements to increase the organization’s agility and to better respond to today’s connected consumers requirements

4.0 Digital Assurance across Industries

Digital commerce set digital transformation in motion, but aspects like Digital Marketing, Digital Supply Chain, Digital Health, Digital Channels for customer engagement and Digital Manufacturing are all taking center stage today across the industries, like in the case of Health care where issues of traditional cost, quality, access and regulatory challenges are addressed through digital means like channels for remote delivery of care, health apps for self-monitoring, online initiatives for patient engagement, analytics on clinical data and online public health campaigns7.

Similarly introduction of smart technologies like grids, meters, and smartphones in the Utilities Sector has transformed the traditional Utility into Digital Utility. Firms target enhanced operational efficiency through remote collection of meter data and enablement of onsite work force with mobile devices which ensure better collaboration with offsite employees. End consumers have access to online portals where they manage their consumption needs, view their consumption data in real time and through forums for promoting energy efficiency programs or to aid in outage management.

Manufacturing is another sector where the need for cost management, better quality and faster time-to-market have led the firms to globalize their operations through digital supply chains. It enables companies to dynamically integrate all their external suppliers and to outsource entire functions of the value chain if need be. Processing and exchange of big data generated through m2m interface, real time order confirmations to optimize production operations, advanced planning and scheduling to optimally allocate production capacity are bringing in never before seen operational process efficiencies to stay ahead of their competition.

With more than 1 Billion mobile phone users expected to use their device for banking transactions by 2017, innovative offerings such as marketing services, sophisticated authentication mechanisms, location-based personalization, enhanced digital security etc. have given mobile and internet banking a completely new dimension in the Financial Services sector. Firms are providing remote advice capabilities by offering investment advice and information on complex products like mortgages via smart-phone, web chat, or video call functionality. Leveraging innovative digital capabilities such as a digital wallet for loyalty cards, spending analysis tools, third-party offers and virtual vaults to store documents are helping the Financial services sector differentiate themselves better. To add to this, firms also look to leverage internal big data and advanced analytics to introduce tailored marketing and product offers. Bottom line is that the digital transformation of banking processes are helping the firms to enhance customer satisfaction resulting in increased loyalty and wallet share from their end customers.

5.0 Conclusion

The number and complexities of PoAs in today’s digital world are beyond the reach of traditional quality assurance practices. Understanding of the business dimension, ability to maneuver technology challenges, access to right tools and enablers are invaluable in building and executing a robust assurance strategy. To ensure success, it is important to engage with the right technology partner who has both the breadth and depth of expertise along with the experience of being on this journey before.

6.0 References

Ramesh Pai is the Practice Head for Wipro’s Business Assurance Practice. Responsible for the Technology, Enterprise and Financial services verticals he has worked with various customers for organizational assurance strategy development, managing large QA program and QA CoE blueprinting with focus on Business Assurance.

To know more about Wipro Assurance Services, write to digital.contact@wipro.com