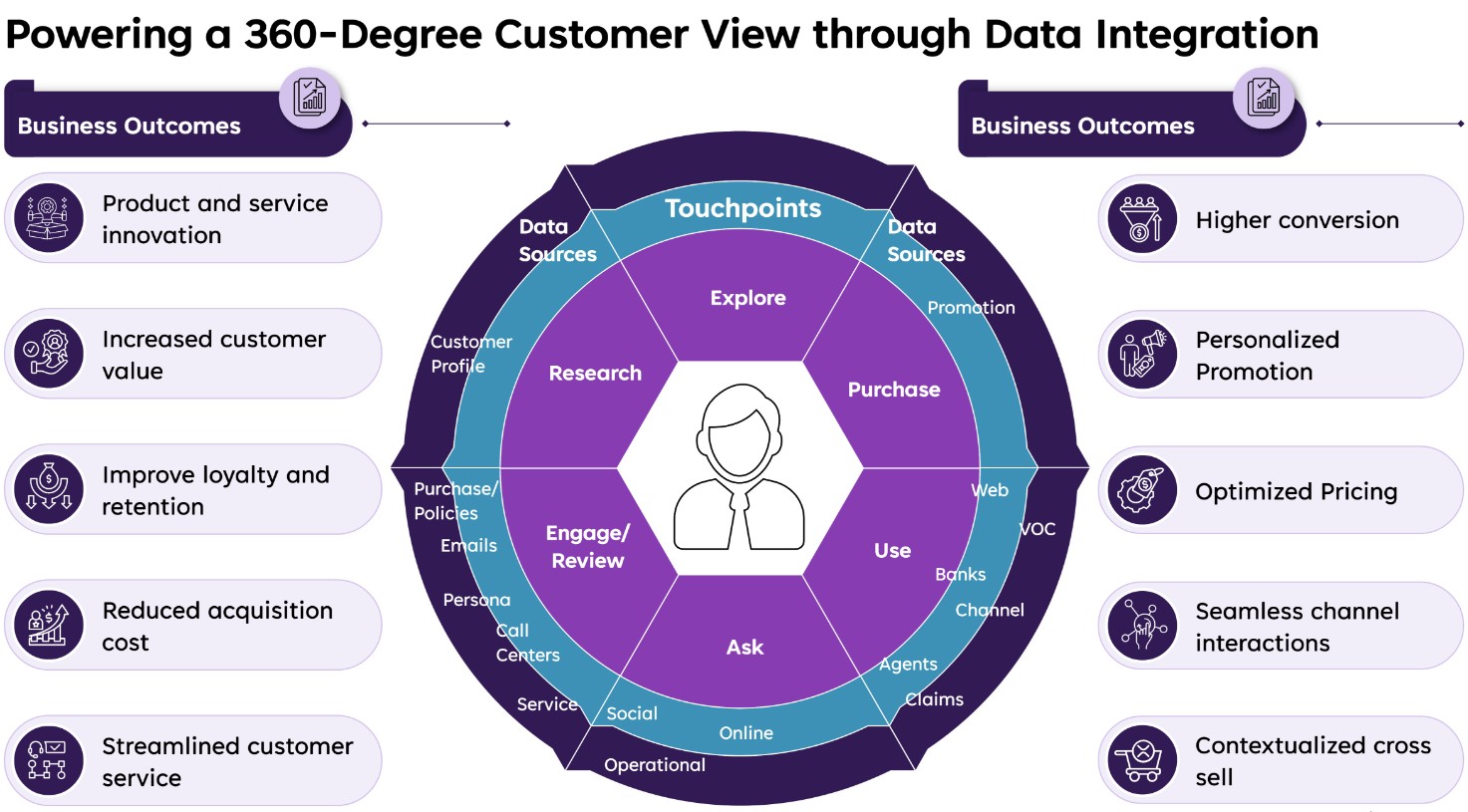

Digital and cloud-native platforms now allow real-time servicing and self-care, ensuring consistency across channels. Advanced analytics build comprehensive customer profiles, helping insurers anticipate needs and personalize journeys. AI powers intelligent chatbots, automates claims, and delivers predictive service recovery. Insurance is increasingly embedded into health, mobility, and lifestyle platforms, making it relevant to customers’ everyday lives.

But technology alone is not enough. Insurers must map the entire customer journey, identifying pain points and opportunities for improvement. Personalization is key—tailoring communications, offers, and services to individual preferences. Consistency across digital and physical channels builds trust, while proactive service demonstrates commitment to customer well-being. Regular feedback mechanisms drive continuous improvement, ensuring that products and services evolve with customer expectations.

When evaluating strategies for CX transformation, it’s imperative to consider how different approaches align with measurable business outcomes such as Net Promoter Score (NPS), retention, and cross-sell. Methods that are scalable across multiple insurance lines and adaptable without extensive re-engineering can help organizations respond to changing market needs. Frameworks that incorporate accelerators and templates may support faster deployment, while built-in regulatory compliance ensures adherence to industry standards. Collaborative models that emphasize co-creation and thought leadership can further support insurers in tailoring their transformation journey to their unique context.

Reimagining Customer Journeys with Predictive Engagement

Most insurers today rely on chatbots and virtual assistants for policy inquiries and claims status, omnichannel platforms that integrate web, mobile, and call center experiences, personalized recommendations using basic analytics for upselling and cross-selling, and self-service portals for policy management and claims filing. While these tools have improved accessibility and convenience, they often fall short in delivering truly proactive, personalized, and seamless experiences. Customers still encounter fragmented interactions, limited personalization, and reactive service that does not anticipate their needs.

Insurers must leverage AI-driven proactive engagement and hyper-personalization to move beyond reactive service and deliver truly seamless experiences. By leveraging predictive customer journey mapping, context-aware conversational AI, and dynamic personalization engines, insurers can anticipate customer needs and deliver contextually relevant support across channels. Integration across underwriting, claims, and service data creates a unified experience, while explainable AI builds trust by making recommendations transparent.

Technology as an Enabler, Not a Barrier

The technology behind these experiences is evolving rapidly. Low-code platforms accelerate innovation, allowing insurers to adapt quickly to changing customer needs. Data and AI fabrics enable real-time personalization and behavioral insights. Ecosystem connectivity enriches journey touchpoints, integrating insurance into lifestyle platforms. API-driven architectures connect core systems and insurtech partners, creating seamless experiences.

Insurers must recognize that technology is an enabler, not a barrier. They should invest in training employees and fostering a culture of empathy and responsiveness. They need to listen to customer feedback and use it to refine products and services. True delight happens when digital meets human—when customers feel known, valued, and protected before they even ask.

Insurers who prioritize CX realize tangible benefits across the value chain. Predictive personalization boosts cross-sell rates, sometimes by two to three times. Satisfied customers remain loyal, reducing acquisition costs and increasing retention. Digital self-service and automation have a measurable impact on operational efficiency, lowering servicing costs by 30% to 40%. These savings free up resources for innovation and growth.

Positive experiences encourage repeat purchases and upselling, driving revenue growth. Memorable interactions inspire customers to recommend the brand, creating powerful advocates. In a crowded marketplace, exceptional CX sets organizations apart, driving efficiency and sustainable competitive advantage.

How Insurers Are Leveraging Cloud and AI for Enhanced CX

Insurance companies are increasingly adopting digital platforms and data-driven models to improve CX and operational efficiency. Wipro has partnered with insurers to enable these transformations using technologies such as Salesforce Financial Services Cloud, Microsoft Dynamics, Guidewire, and Duck Creek.

- Claims Modernization: For a major U.S. insurer, Wipro implemented a modern claims platform and integrated fintech solutions to support usage-based insurance and real-time event capture.

- Personalized Engagement: A health insurer leveraged Wipro’s Digital Experience Management (DCxM) solution to unify customer data and deliver tailored offers via email and app notifications, leading to a 40% increase in engagement.

- Agent Enablement: A global insurer improved policy conversions by 25% after adopting Wipro’s unified Customer Management Portal, which provides AI-driven recommendations for agents.

By leveraging cloud-native data hubs and omnichannel strategies, insurers are delivering seamless self-service options and personalized experiences across multiple touchpoints.

The Way Forward: Becoming Life Enablers

To lead in the experience economy, insurers must evolve from policy issuers into life enablers, integrating protection, prevention, and personalization into a seamless journey. This requires bold investments in technology, empowered teams, and a deep understanding of customer needs. Every touchpoint should matter, where CX is the new premium.

Organizations that elevate CX will earn loyalty, spark innovation, and capture growth in global markets. Ultimately, the insurers that thrive will be those who make customers feel protected, valued, and understood—at every moment, in every interaction.