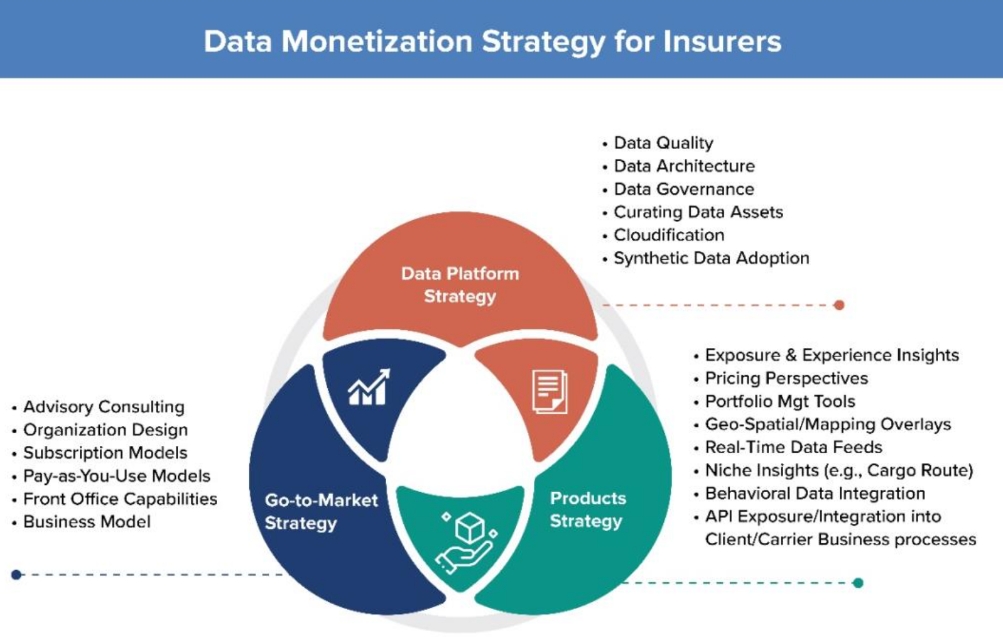

1. Data Platform Strategy

A data monetization strategy must start by examining the company’s data architecture. The data architecture governs data collection, management, consumption, and distribution throughout the organization. A paradigm shift in data management is underway, driven by knowledge graphs that enable thriving distributed data assets within an organization. Knowledge graph-centered architecture is becoming a central focus due to its advanced ability to make organizations GenAI-ready. These datasets must be safely combined and analyzed to maximize the monetization potential of data assets. This data architecture is foundational to artificial intelligence (AI) applications.

Another architectural consideration is the growing use of hyperscalers. These cloud-based solution providers offer evolving analytics and tooling, as well as scalable computing power that keeps up with ever-increasing data growth. Cloud technology allows companies to share real-time data at scale and further facilitates monetization through new models like subscription-based information-sharing platforms. Companies should ensure that their data architecture can address data quality with new data flow requirements across data platforms (cloud or non-cloud, hyperscaler, bespoke, etc.) or analytics partners. They should also address how the data foundations and knowledge graphs can help leverage machine learning, Gen AI, and analytics to enrich data assets.

2. Products Strategy

Companies should start by identifying which data assets can be leveraged for new products or services (with or without support from the ecosystem). To begin this strategy, think “new vs. better”. Can the new product or service improve existing offerings, is it a new product launch? For example, the new InsurTech ecosystem could provide a service option – exposing some data to junior partners through API layers for insights. These new entrants are experts in building behavioral analytics models and using new tech to drive value and opportunity. Partnerships with InsurTechs could also open new possibilities with generative AI or advanced ML modeling.

Insurers should consider the product evolution journey. Does the product have the potential to grow over time? How feasible is it, and what are the constraints? For example, an IoT data product can begin as a predictive maintenance solution for logistics companies. It can later evolve into an ecosystem-enriched vehicle uptime and customer assurance solution drawing on cross-party data from manufacturers, service providers, and consumers.

3. Go-to-Market Strategy

There is no such thing as a one-size-fits-all approach to monetization. The highest-performing companies begin with internal data monetization before selling data to third parties. When developing a market strategy, consider whether your organization will allow data analysis within your platform or provide third-party view-only access to your insights (for example, offering insights-as-a-service or product). Adopting the best go-to-market approach for data monetization depends on whether you sell a product or service, the in-depth expertise needed, and how to deliver data assets.

Such a wealth of service offerings from multiple players poses another decision for insurers: What will service delivery look like (data feed, advice, report, subscription, license, or one-time fees)?Insurers undertaking data monetization efforts should consider possible disruptions to core broker/client/carrier relationships. Large insurance brokers, for example, are setting up advisory consulting businesses to support existing clients, and some are providing crucial cybersecurity services to organizations. Some carriers and re-insurers are setting up AI modeling factories for internal and external data monetization, and ‘risk solutions’ lines of business are emerging. Partners may be able to tolerate some competition around data monetization, but at times, such competition may change the nature of the partnership. Given how the product/service portfolios of different constituents (brokers, insurers) are evolving, existing ways of working are no longer the same. Conflicts of interest, cannibalization, and other evolving dynamics may destabilize the current market relationship.

A Real-World Example

One of our global insurance brokering clients operating in 130+ countries wanted to re-imagine its data products. The company was experiencing market saturation, declining projections in existing product lines, and threats from new entrants experimenting with innovative data products. To meet changing client demands, the firm needed to re-position. How could the insurance giant re-imagine and monetize its data products portfolio to unlock new revenue lines for the business?

The three-pronged approach outlined above enabled the company to create a successful data monetization journey. Through AI-powered mapping solutions and graph technologies, the company was able to accelerate the linking of various independent data and intelligence products and rapidly unlock new monetization opportunities. The strategy helped the company identify approximately $100M in monetizable data product lines. The firm added direct-to-consumer selling channels and innovative commercial models in service line businesses.

New Data Strategies to Avoid Disruption

Carriers, brokers, and reinsurers have a significant and largely untapped market opportunity to create value through data monetization. The ability of any firm to realize this potential will depend on its capacity to understand client expectations (including the latent market for data assets), ensure that the foundational building blocks are in place, and define a clear execution path. For most insurance providers, this is as much an exercise in changing the market dynamics as it is an internal change management exercise.

Companies can successfully navigate new data monetization opportunities by addressing the three levers mentioned in the Data Monetization Strategy for Insurers section above. This strategy will lead to tailored, personalized experiences, services, and customer-centric products (including targeted marketing programs). Over time, this will enable companies to create a competitive edge and avoid forfeiting revenue and market positioning to traditional and new players.

Locations

Locations