Introduction

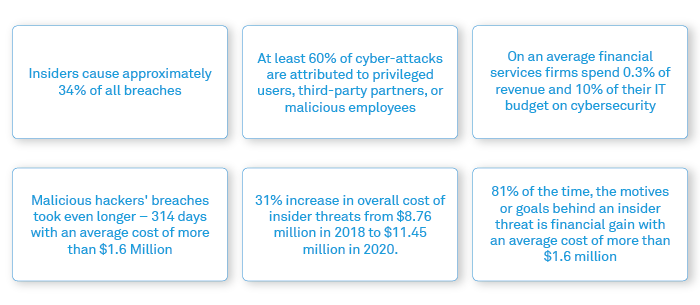

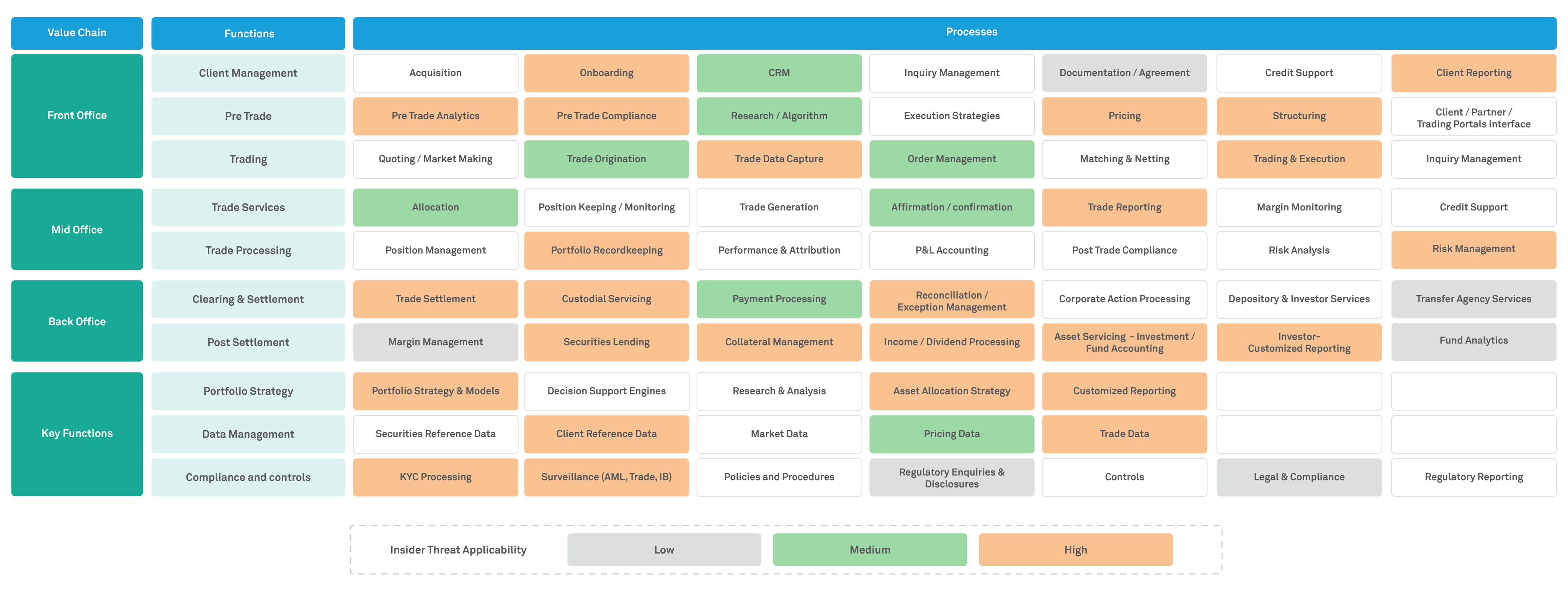

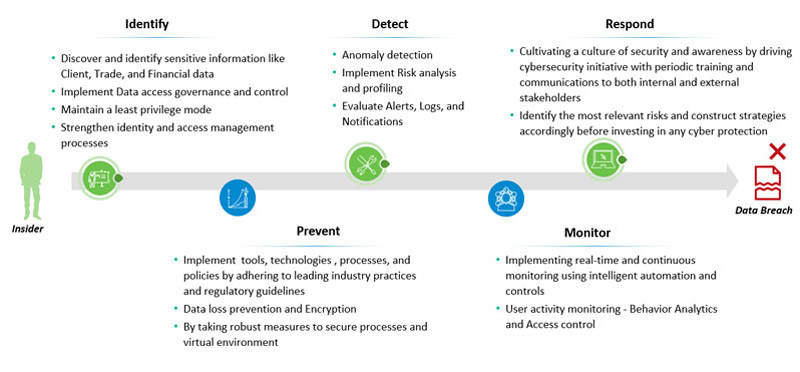

Cyber-attack threats are on the rise, and the cost of Cybercrime continues to increase in the financial services industry. In the next five years, Cybercrime cost is expected to increase by 40%. Although large-scale cyber-attacks have occurred over the past 15 years in the form of distributed denial of service, data theft, loss of intellectual property, and cyber fraud, their impact has grown faster than the firm’s ability to prevent and recover from it. Usually, organizations focus on external threats, but insiders are often more likely to be the cyber-attack source in Capital Markets. One of the largest global bank recently faced a loss of $900 million due to an insider breach; this is testimony to the fact that internal cyber-attacks are more common than many assume.

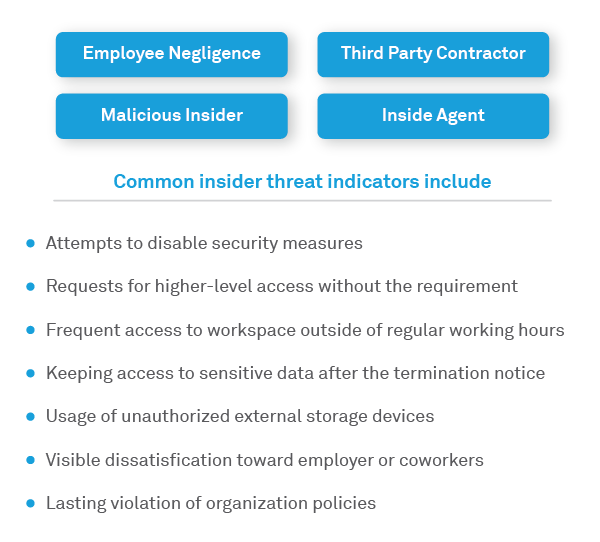

Humans are the weakest link in cybersecurity. Employee negligence and lack of awareness remain to be the top threats for Capital Market firms as far as cyber risk is concerned. A Gartner study on criminal insider threats found that 62% of insiders with malicious intent are classified as people who are looking for extra financial gain. 14% of malicious insiders were in a leadership role, and around 1/3rd had access to sensitive information.

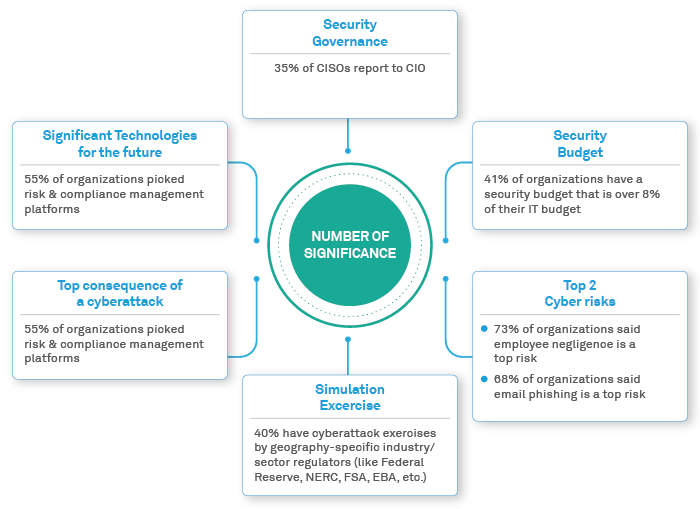

As per Wipro’s State of Cybersecurity Report (SOCR) - The top cyber risks that financial services organizations face today are: