The Shift Toward Agentic Commerce

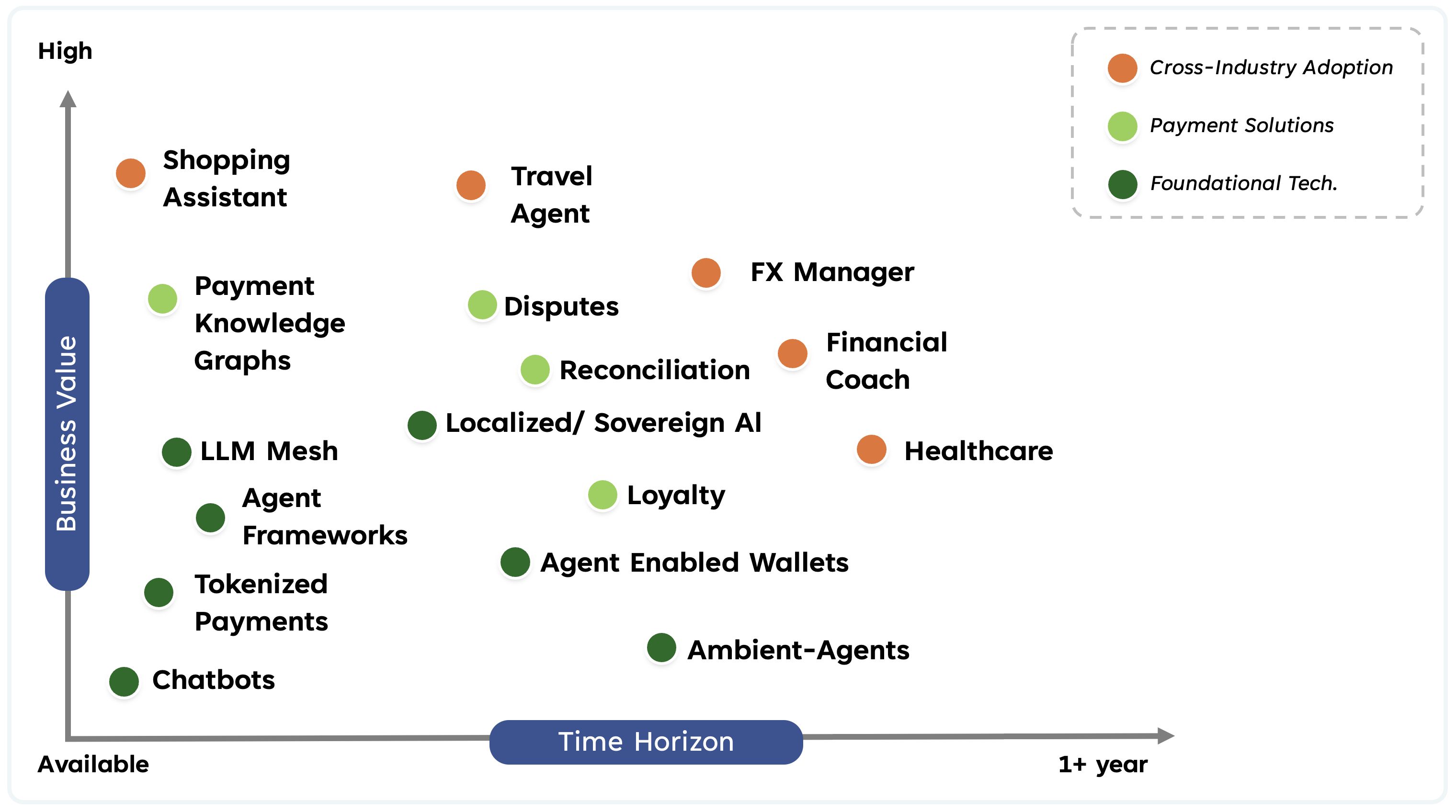

Commerce is evolving fast, thanks to the rise of agentic AI where smart AI agents and tokenized payments combine to create more intelligent and autonomous transactions. This shift is already reshaping industries like retail, travel, healthcare, and wealth management. The agentic AI in retail and eCommerce market size reached USD 46.74 billion in 2025 and is forecast to climb to USD 175.11 billion by 2030, translating into a robust 30.2% CAGR over the period.

A few big changes are driving this transformation:

- Increasingly complex markets, with more transactions, data, and payment channels.

- Advanced AI agents that make real-time decisions, spot fraud, and personalize services.

- Stricter compliance and security rules, requiring smarter, adaptable systems.

We are seeing this in action with features like Mastercard Agent Pay, Visa Intelligent Commerce and Amazon’s “Buy for Me” AI shopping agent. The move to agentic commerce isn’t just a future trend; it’s happening now, promising smarter and more personalized experiences.