The mortgage origination process today is human-intensive and time-consuming. On an average, it takes 35 to 40 days to close a loan. Lenders work with multiple service providers and business partners to perform many functions related to data collection and verification. The lender’s profit margin has decreased due to the upward trend in production costs such as commissions, compensations, brick and mortar, equipment, staff and other production expenses. The traditional way of processing loans continues to add costs to the loan manufacturing process.

The need for process automation is significant to increase productivity, reduce operational costs, minimize human errors, and provide better user / consumer experiences. Lenders have many opportunities to automate the mortgage origination process and transform the traditional method of processing through digital solutions.

Automation is the key

Majority of the paper-based processes happen during the initial stages of loan origination and these are highly time-consuming events. Process automation is the way forward for lenders to improve traditional business models.

Lenders need to:

- Automate data capture and data collection events

- Enable digital verification processes throughout the loan cycle

- Automate processing and underwriting events completely

- Automate the document generation process (e.g. initial disclosure, closing disclosures, etc.) and enable digital delivery of the same

- Enable real-time integration of all associated parties with loan origination system(LOS) for exchanging data between applications

- Introduce e-closing, recording and vaulting options. Provide online collaboration with settlement agents, counties, notaries, etc.

- Enable automated workflow models in the LOS to complete events automatically

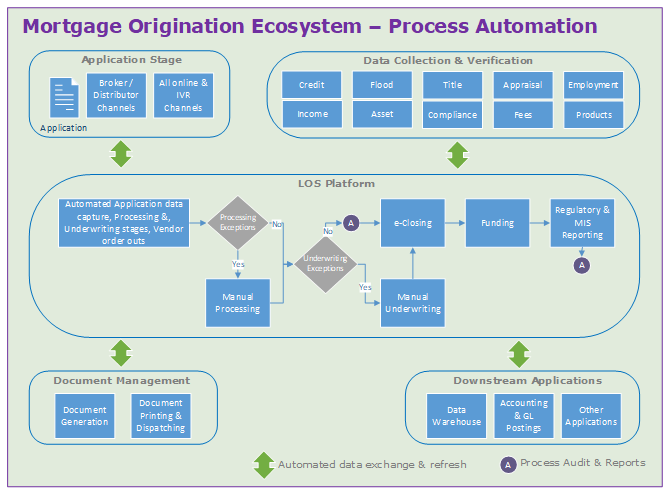

Enabling these functions in the origination cycle will bring down the loan-processing time from weeks to days. Lenders should design a good governance model in the mortgage origination process to audit system transactions through various system reports and touchpoints. Figure 1 shows the blueprint for automation in the mortgage origination ecosystem.

Adopting automation using technologies such as API, Microservices, ADR/OCR, Artificial intelligence and Machine Learning are doable in any technology platform. Integrating these technologies into loan origination system will vastly reduce mundane human work, decrease overall processing time and manage huge transactions volumes effortlessly.

Figure 1: Automation in mortgage origination process

The business advantage

By leveraging automation using technologies such as API, Microservices, Artificial intelligence etc., significant facelift will be made in the loan origination system and its integrated system. Lenders can look for the following key business drivers to begin with:

- Implementation of one click pre-approval process for loans that has sufficient data and previous transaction details

- Originate refinancing loans in less than a week or within a few days by digital verifications

- Minimum of 50% reduction in processing time on Purchase loans

- Enrich the user and consumer experience

- Transformation into new business operating model with cost effectiveness by increasing efficiency and agility in the process

The way forward

Automation is the driving force that enables new business models across industries, and mortgage industry is no exception. Lenders should focus on automating most of the origination processes to embrace new ways of loan origination. Globally, the budget allocation among organizations on digital transformation projects are on the rise and those who adopt automation today will sustain in the marketplace by increasing their profits margin and market shares significantly.

NetOxygen digital lending solutions enables plugin features to support automation everywhere. The product supports lenders in configuring automated workflows that suit their needs and reduce loan-processing time. To know more, click here.

About the Author

Sridhar Sathyanarayan

Managing Consultant, Banking Practice, Wipro Ltd.

Sridhar is a Certified Scrum Product Owner and Certified Data Analyst with 13+ years of experience in financial services. He has broad expertise across Capital Markets and Lending portfolios with a strong focus on Wealth Management and US Residential Mortgage domains. He is currently managing product development and engineering for one of the global banks in the US.

Sridhar is involved in consulting and advisory for the loan origination solution NetOxygen. He can be reached at sridhar.sathyanarayan@wipro.com