Decarbonization journeys are accelerating across all industries. An expansion of wind and solar projects, a growing EV sector, and emerging climate-related regulations are changing the energy industry's calculus. Looking several decades into the future, major oil and gas companies are issuing ambitious climate targets and even net-zero pledges.

Many oil and gas companies focus on reducing the carbon intensity of their internal operations. Curbing carbon dioxide and methane emissions across the entire value chain is a priority. To advance these imperatives, new digital-first approaches — including the Internet of Things (IoT), digital twins, artificial intelligence, and predictive/prescriptive analytics — will play a crucial role in measuring emissions, modeling future scenarios, and advancing carbon-reduction interventions. These emerging digital capabilities will be particularly impactful in the carbon-intensive upstream domain.

Upstream Decarbonization: A Technology-driven Pathway

The 2015 Paris Agreement—the most wide-reaching effort to address climate change and global warming to date—aims to restrict the global temperature rise to 1.5°C above pre-industrial levels. According to the World Economic Forum’s Global Risk Report, achieving this will require reducing human-caused CO2 emissions by 50% by 2030 relative to 2010 and to net zero by 2050.

In the long term, energy companies must address all their carbon emissions, including the Scope 3 emissions created when consumers and enterprises use oil and gas products. But even before those new low-carbon business models come fully into focus, energy companies can significantly reduce their Scope 1 and 2 emissions. According to the International Energy Agency, Scope 1 and 2 emissions of oil and gas production, transport, and processing are responsible for 15% of all global greenhouse gas emissions. Upstream oil and gas companies can make significant progress toward a net-zero future by achieving near-term reductions in these Scope 1 and 2 emissions.

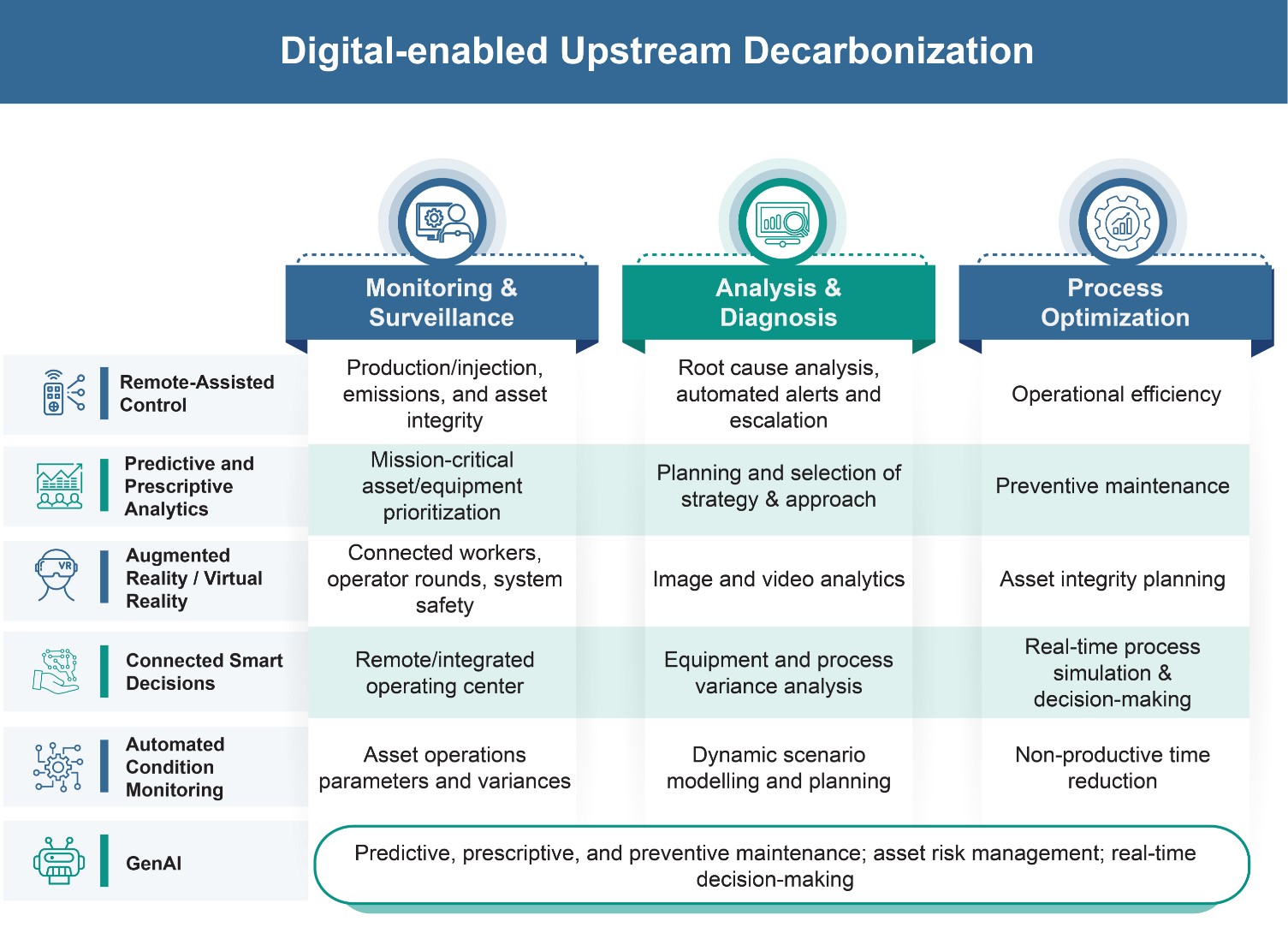

A suite of emerging technologies will give energy companies the tools to address Scope 1 and 2 emissions rapidly. Fortunately, oil and gas companies are incorporating many of these tools — AI/ML, digital twins, IoT, robots/drones, augmented reality, and integrated data platforms — to address operational challenges like equipment maintenance and reliability, remote operations, and asset integrity. These technologies will enable concrete sustainability advancements by facilitating real-time, data-driven decision-making.

Three Decarbonization Priorities for Upstream

Three sequential capabilities will help energy companies leverage these technology tools to reduce emissions and advance their sustainability goals: Asset monitoring and surveillance, analysis and diagnosis, and optimization (see figure below).

Locations

Locations